Cat & Jack in Canada: Target expands kids brand in Hudson Bay and considers other international markets

The private-label children's line will be expanded at Hudson's Bay stores as international retailers show interest in selling the Minneapolis-based Target's brands.

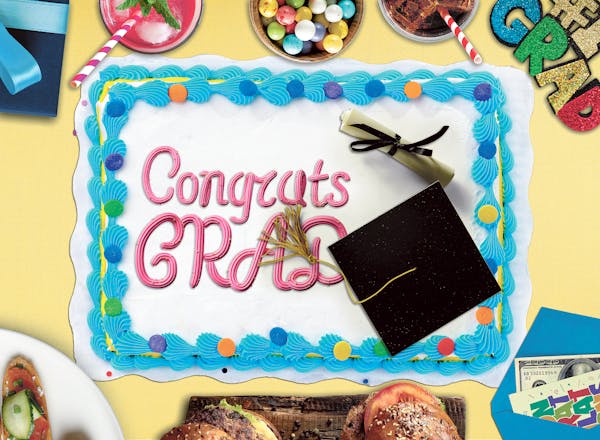

How to survive graduation season: What you need to know about parties, gifts and planning

Managing graduation parties, events and gifts Minneapolis

Duluth electric utility owner Allete to go private after $6.2 billion sale

A Canadian pension board and an investment fund partnered to buy the company, which will keep its headquarters in Minnesota.

Business

Ryan will equip worksites with Narcan as more construction companies address mental health

The Minneapolis-based developer worked with a White House effort to address overdoses. The industry has one of the highest rates of opioid abuse, federal statistics show.

Business

Balls, orbs or neurons: The pioneering tech helping Great River Energy manage transmission lines

A small sphere Norway's Heimdall Power created aims to free up space and reduce congestion, potentially eliminating the need for new infrastructure.

Business

Minnesota AG Ellison brings charges in Faribault area Medicaid fraud scheme

Co-conspirators are accused of fraudulent billing for transportation, interpreter and specialty clinic services.

Business

Money, Work, Know-How

Stories for Minnesotans who want to develop careers, build businesses, find opportunities, make more money and spend it wisely — and about the people who can help them do it.

Local

Planters recalls honey-roasted peanuts, mixed nuts packages over possible listeria contamination

The recall affects Publix distribution sites in four states and Dollar Tree warehouses in two.

Business

Is your company on the list of Minnesota's 2022 Top Workplaces?

Worker expectations change at Minnesota firms as pandemic retreats.

Business

Minnesota Power agrees to smaller bill increase for customers in settlement

If utility regulators approve the deal with state officials, residential customers' electric rates would increase 4.9% instead of the originally posed 12%.

Business

Ramstad: In a tight labor market, job fairs have changed to find people on the margins

Organizers are trying to help people who have been on the margins of the labor market, as demand for workers remains high.

Business

Remodeling your home is easier when you put it in writing first

Once you find a stellar home improvement company, you need a firm written agreement that will help you eliminate common sources of disputes with contractors.

Business

U.S. Bancorp names Gunjan Kedia new president

Kedia, whose previous title was vice chair of wealth, corporate, commercial and institutional banking, takes the role previously held by chief executive and chairman Andy Cecere.

Business

Midwest Mountaineering alum opens outdoor store to fill void

Lake State Mountaineering offers paddling and climbing supplies for Minnesota outdoors enthusiasts.

Minneapolis

Minneapolis residential property taxes could rise steeply in 2025

With federal COVID funds drying up and downtown commercial values falling, homeowners and renters will be asked to shoulder the burden, Mayor Jacob Frey cautions.

Business

With $324.2 billion in revenue, UnitedHealth again tops list of Minnesota public companies

The top 50 companies as a whole posted revenue of $750.7 billion, up 7% from the year before. However, growth was slower than in 2021.

Business

Best Buy CEO Corie Barry's compensation fell more than 20% to $10.3M last year

The company failed to meet financial goals, triggering lower payouts for executives.

Business

Sundaes in Shanghai: Dairy Queen expands global empire

The Minnesota-based franchisor is seeing sales and profits steadily climb as its international ambition grows.

Business

After failed mediation, Timberwolves, Lynx ownership dispute heads to arbitration

Arbitration process will take place in Minneapolis and must be completed within six months, according to contract.

Business

3M paying back nearly $1M in overpayments improperly deducted from employee paychecks

The company reached a settlement with the state Attorney General's Office to issue about 1,700 checks.

Business

Eden Prairie refrigeration facility laying off 91 workers

St. Louis-based Copeland Cold Chain is moving manufacturing and distribution operations to other North American locations.

Business

Life Time goes full wellness, with spa offering weight-loss management, including Ozempic

The Chanhassen-based company continues to expand, including pickleball facilities.

We've created a new destination for everything agriculture in Minnesota and around the country.

Business

Cargill recalls 16,000 pounds of ground beef over E. coli risk

None of the affected products were sold in Minnesota, and no illnesses were reported.

Cannabis

Minnesota hemp businesses feeling burned by Lucky Leaf cannabis expo organizers

Local entrepreneurs say they were misled by the Texas-based event company about whether they would be allowed to sell their THC and CBD products at the show last week in Minneapolis.

St. Cloud

Barely any venture capital makes it to greater Minnesota. Meet the folks trying to change that.

Over the last decade, less than 4% of venture capital invested in the state went outside the Twin Cities.

Browse Business Sections

Latest Columns

Elsewhere in Business

- Nintendo to announce Switch successor in this fiscal year as profits rise

- Congo military releases 2 Kenya Airways staffers held for 2 weeks over cargo dispute

- Stock market today: Asian shares mostly higher, though China benchmarks falter

- Macron puts trade and Ukraine as top priorities as China's Xi opens European visit in France

- Workers at Stellantis plant near Detroit authorize strike in dispute over health and safety issues

- The FAA investigates after Boeing says workers in South Carolina falsified 787 inspection records

- A US company is fined $650,000 for illegally hiring children to clean meat processing plants

- Medicare and Social Security go-broke dates are pushed back in a 'measure of good news'

- Slain nurse's husband sues health care company, alleging it ignored employees' safety concerns

- How major US stock indexes fared Monday, 5/6/2024

Most Read

- Duluth electric utility owner Allete to go private after $6.2 billion sale

- Cat & Jack in Canada: Target expands kids brand in Hudson Bay and considers other international markets

- Congress slams UnitedHealth's cybersecurity, calls company 'a monopoly on steroids'

- Minnesota AG Ellison brings charges in Faribault area Medicaid fraud scheme

- How to survive graduation season: What you need to know about parties, gifts and planning

Business

Complete coverage of business news in the Twin Cities, Minnesota and elsewhere, including Fortune 500 Minnesota companies: UnitedHealth Group, Target, Best Buy, 3M, CHS, U.S. Bancorp, General Mills, C.H. Robinson, Land O’Lakes, Ecolab, Ameriprise Financial, Xcel Energy, Hormel Foods, Thrivent Financial, Polaris, Securian Financial Group, Fastenal and Patterson Cos.