Why are there suddenly credit unions 'everywhere' in Minnesota?

Listen and subscribe to our podcast: Via Apple Podcasts | Spotify | Stitcher

If it feels like there are more credit union branches than there used to be, you are not imagining things.

A reader contacted Curious Minnesota noting that when they moved to Minnesota about a decade ago, there were just a handful of credit unions.

"Now, almost a decade later, they seem to be everywhere in the [Twin Cities] and suburbs/exurbs," they wrote to Curious Minnesota, the Star Tribune's reader-powered reporting project. "What's changed?"

Credit unions have been opening up more branches across Minnesota in recent years, even as the overall number of credit unions has been shrinking. It's a reflection in part of how much more proactive many credit unions have become about growth, expansion and marketing to stay relevant in a competitive industry.

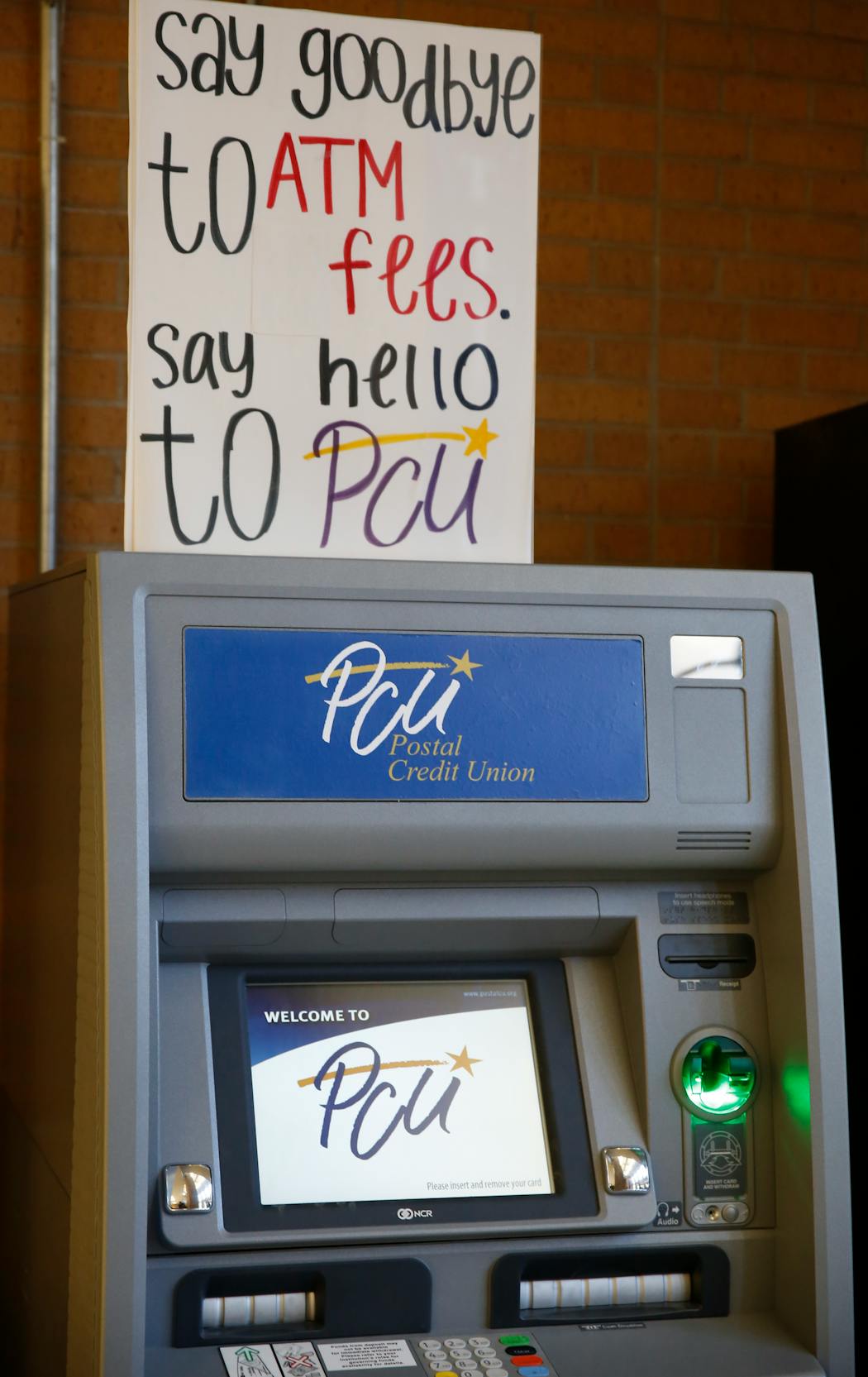

Credit unions offer many similar services as banks, such as checking and savings accounts as well as auto and mortgage lending. But they are also not-for-profit entities owned by their members. So instead of funneling profits back to shareholders, they redirect them back into the organization by offering perks such as reduced fees or lower rates on loans.

They are also likely appealing to those who are looking for a more personal, local touch, especially among consumers who are fed up with traditional big banks, which have come under scrutiny in recent years for excessive fees and other questionable practices.

"Your reader is spot on that they are increasingly seeing credit unions around," said Mara Humphrey, CEO of the Minnesota Credit Union Network. "We've seen an increase in branches in credit unions in Minnesota and also in the number of branches per credit union."

There are now about 400 credit union branches throughout Minnesota compared with about 373 a decade ago, she said. That's a 7% increase.

Traditional banks, by contrast, have been closing branches at a similar clip over the last decade, Humphrey pointed out. Banks have been consolidating branches, especially as consumers do more of their banking online through mobile apps.

Credit unions have expanded their online presence with apps of their own, Humphrey added. But opening new physical locations remains an especially important strategy for credit unions, which are being more aggressive than they have in the past about building awareness and finding new members.

Fewer, bigger credit unions

It seems to be working. The membership ranks of Minnesota credit unions have steadily increased over the decades to 2.1 million members, which includes some people who live in other states.

The number of different credit unions in Minnesota has actually been declining, however, mirroring a nationwide trend. There are currently about 87 credit unions in the state, down from 135 a decade ago and from 180 two decades ago.

In fact, the number of credit unions peaked in Minnesota in 1963 — when there were 490.

Similar to banks, credit unions have consolidated through waves of mergers, especially as smaller unions have struggled with membership numbers, higher regulation and technology costs, and an increasingly competitive banking landscape.

Those mergers have created larger credit unions, which are adding more branches and broadening their membership in order to remain healthy and to be able to invest in things like technology.

"Credit unions are growing — the larger are getting bigger, and the smaller are just having challenges to compete," said Dan Stoltz, CEO of Spire Credit Union.

Broadening membership

Many credit unions started off — and some still continue to be — focused around an employer. In that case, people could only join if they or a family member worked at that company. But in recent years, many have opened up their membership eligibility.

For example, the largest credit union in Minnesota, Wings Financial Credit Union, started off as being just for airline workers. It was founded in 1938 by a group of Northwest Airlines employees. Today, its membership is open to people who live in more than 30 counties in Minnesota, as well as in other metro areas that are big airline hubs — like Seattle, Detroit and Atlanta.

It's a similar story with many of the state's other biggest credit unions. TruStone Financial Credit Union was once just for teachers and Hiway Credit Union was initially for employees of the Minnesota Department of Transportation. Both have since expanded eligibility to include the local communities where they are based.

The State Capitol Credit Union changed its name to Affinity Plus Federal Credit Union in 1999 to signal it was no longer just for state employees. Today, a person can join Affinity Plus if they work for any state-funded organization, attended a state university, live, work or worship in several parts of the Twin Cities, or donate to its foundation.

"So there's really no way you can't be a member of Affinity Plus," said Dave Larson, Affinity's CEO.

More marketing, branches

Spire Credit Union has tripled its ranks since 2010, growing from about 50,000 members to more than 150,000 today. Stoltz attributes much of that growth to stepped-up marketing efforts, adding new locations and mergers.

Spire has grown its number of branches during that time from 10 to 22 and has plans to continue opening a new branch a year for the foreseeable future, he said.

"The branches are still very, very important," said Stoltz. "We hear it from our member base that they still want a person to talk to."

Spire has also merged with about 10 credit unions in the past decade — from entities in places like Hibbing and Pine City to employer-focused credit unions such as those for EcoLab and Hubbard Broadcasting.

Spire didn't do a lot of marketing when Stoltz took over as CEO in 2010. Neither did a lot of credit unions around that time.

But Stoltz knew Spire needed to do something different because it was in poor shape coming out of the Great Recession.

So the organization started doing TV commercials featuring Stoltz and a blue pickup truck. Over the years, Spire has expanded those efforts to include radio ads, billboards and social media. It has a roster of high-profile endorsers, including Vikings quarterback Kirk Cousins, National Baseball Hall of Famer Tony Oliva and Olympic gold medalist wrestler Gable Steveson.

"Credit unions have finally stepped up and said, 'Look, you can't sell a secret,'" Stoltz said. "Let's talk about who we are."

Word of mouth, smaller branches

While Affinity Plus hasn't done many mergers, marketing has helped it grow, too, Larson said.

Affinity Plus has increased its membership between 5% and 7% in recent years and projects it will add about 25,000 new members this year, which would be the highest number in its history, he said. It now has around 250,000 members.

More than 65% of its new members come from a referral of an existing member.

"When you love something, then you tell people about it," Larson said.

Affinity Plus is eyeing adding more branches in more markets, too. It currently has about 30 locations and has plans to open new ones later this year in Shakopee and in the eastern part of the metro.

The newer locations are smaller, Larson added. They might have one drive-thru lane instead of four because they don't need as much space in an increasingly digital banking world.

Opening branches also helps attract new members, he said.

"The more success we have, the more we can give back to the members and give back to the employees and the community as a whole," Larson said.

If you'd like to submit a Curious Minnesota question, fill out the form below:

Read more Curious Minnesota stories:

What happened to Minneapolis' famous Weatherball?

Why do so many Fortune 500 companies call Minnesota home?

Why are Honeycrisp apples still so expensive?

Is Minnesota really one of the nation's top sugar producers?

How did Minnesota become a window manufacturing hub?

Why can't you buy a car on Sundays in Minnesota?