More than three years after the death of Carl Pohlad, the estate of the billionaire business magnate is mired in a tax dispute with the IRS that has potentially huge financial consequences.

The agency claims that Pohlad's heirs owe the IRS more than $207 million, largely on the basis of a purportedly low valuation the estate placed on the late patriarch's most visible asset, the Minnesota Twins. The tax collector also wants $48 million as an "accuracy related penalty" for a total potential tax bill of $255.8 million.

The Pohlad family disputes the IRS position and asserts that the federal agency greatly overvalued Carl Pohlad's interest in the Twins after he handed most of the control of the ballclub to his sons in the years leading up to his death in 2009.

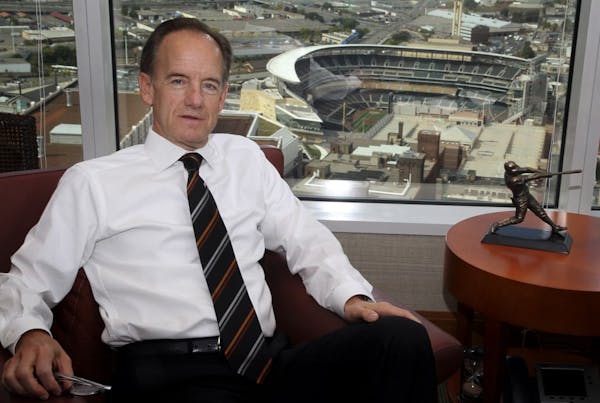

"We believe strongly in our position and are working with the IRS to resolve the differences following their normal procedures," said Jim Pohlad, oldest of the three Pohlad sons.

"We are respectful of the IRS and its position," he said in an interview. "Clearly, we expected this but we just wish the process didn't take so long. Our position is to resume negotiations as soon as both parties can."

IRS officials declined to comment on the dispute last week.

But according to tax attorneys not connected with the case, the Pohlads will be on the defensive in this dispute.

"The burden is on the taxpayer to prove the IRS wrong," said Barry Gersick, an estate-planning attorney with the Minneapolis firm of Maslon Edelman Borman & Brand.

According to the experts hired by the estate, Carl Pohlad's interest in the Twins was just $24 million at the time of his death in early 2009. The IRS places the value of those assets at $293 million.

The Pohlad estate asserts that Carl Pohlad's minority ownership of the Twins at the time of his death — with his three sons controlling 90 percent of the voting shares of the club — is not adequately reflected in the IRS valuation, nor is the Great Recession, which confronted the U.S. economy at the time.

The dispute surfaced last month in U.S. Tax Court, a division of the federal judicial system where tax cases can sometimes linger in near-obscurity for years.

The Pohlad estate has requested a Tax Court trial in Houston, home of the law firm handling its tax case, Baker Botts. However, further negotiations toward a settlement are expected well before any trial date is set, said Baker Botts attorney John Porter.

An IRS spokeswoman, Karen Connelly, said last week that the agency "does not comment about ongoing litigation" when asked about the assertions in the Pohlad petition. But in its "notice of deficiency" to the Pohlad estate, the IRS asserts that the extra tax it is seeking is the result of "a substantial estate tax valuation understatement."

Estate and family financial planning experts said the Pohlad case is notable for the dollar amount involved and the sophistication of the advisers retained by the family to handle the inheritance and gift tax matters.

"I don't think the Pohlads are doing anything shady," said Tom Hubler, the head of Hubler for Business Families, a Minneapolis-based family business consulting firm. "It's one of those disputes where the Pohlads and their advisers devised a plan for looking at the estate and the IRS is saying 'no, no, no.' "

At $255.8 million, the dispute would be among the richest pending before the Tax Court, said Gersick.

"Just the size of the estate would generate an audit," he said in an interview.

According to tax experts, the IRS notice of deficiency and the Pohlad estate's Tax Court petition can be viewed as preliminary salvos in a high-stakes negotiating process.

"If you disagree with the IRS, you have two choices. You can take it to Tax Court, which the Pohlads did, or you can pay the tax and file a refund claim," said Gersick. "Most of the time, 90 percent of these cases get settled. If you make it to Tax Court, judges tend to be like Solomon and split the baby."

The Pohlad family fortune ranges from financial services to commercial real estate to media and retail car dealerships.

But at the heart of the IRS matter are values placed on a pair of entities in which Carl Pohlad held partial ownership of the Twins, which he originally purchased in 1984 for $44 million. The estate's contention is that those entities did not give him control of the Twins.

The two companies are MT Sports, through which the Carl Pohlad estate had a 99 percent nonvoting, non-controlling interest in the team, and Twins Sports Inc., the unit that serves as the managing entity of the Twins organization, in which Carl Pohlad had a 10 percent voting interest. The three Pohlad sons, Jim, Robert and William, control the remainder of the voting shares with 30 percent each.

Combined, Carl Pohlad's financial interest in the Twins was posted at just shy of $24 million, according to the Tax Court petition. The total value of the Twins at the time of Pohlad's death was estimated at $356 million by Forbes magazine. But Porter, the Baker Botts attorney representing the Pohlads in the IRS matter, said the valuation figures are gross figures that don't include liabilities such as stadium debt. Moreover, Porter said, the economic environment was not conducive to the sale of sports franchises at the time of Carl Pohlad's death.

Only two major league teams were sold in the period immediately before the death of Carl Pohlad — the Washington Nationals in 2006 for $450 million and Atlanta Braves a year later for the same amount.

"You couldn't find a worse environment than the beginning of 2009," Porter said in an interview.

Chicago-based sports franchise consultant Marc Ganis agreed.

"The Pohlads are right. There was a significant reduction in the value of a franchise in 2009 because of a lack of liquidity in financial institutions at the time," said Ganis, president of SportsCorp Ltd.

Ganis said he served as an adviser to the Tribune Co. in 2009 when it was attempting to sell the Chicago Cubs, a storied and valuable Major League Baseball franchise. Initial bids were more than $1.2 billion but the ultimate sale price was $900 million because banks didn't have the money to lend at the time.

"Had the Twins been for sale, the same would have happened to them, too," Ganis said.

Ganis said the ultimate ownership stake attributed to Carl Pohlad's interest in the Twins will likely be north of the $24 million claimed by the estate but less than the $293 million sought by the IRS.

"The control premium is there and the illiquid investment premium is there but you are not looking at a $25 million enterprise value. That's not realistic, either," Ganis said.

David Phelps • 612-673-7269

Kansas' governor has killed proposed limits on foreign land ownership

Federal judge temporarily halts Biden plan to lower credit card late fees to $8

Gov. Gavin Newsom proposes painful cuts to close California's growing budget deficit