The owner of the Mall of America continues to be months behind on its mortgage payments and has entered a cash-management agreement to avoid foreclosure.

The MOA's owner, Triple Five Group, started having trouble meeting the mortgage after the mall had to close in March due to state-mandated efforts to curb the spread of coronavirus.

The loan was transferred to special servicing in May after Canada-based Triple Five was no longer making full payments. At the time, a mall representative said revenue had fallen 85%.

Now the special servicer has entered into a cash-management agreement with Triple Five requiring increased reporting requirements and monthly remittance of net cash, according to a report issued Tuesday by data firm Trepp.

The special servicer, CWCapital Asset Management, could not be reached on Wednesday.

The Mall of America's collateral value, which was $2.3 billion in 2014, has decreased to $1.9 billion, according to Trepp.

Malls across the country have mountains to climb as they deal with struggling tenants, several of which have filed for bankruptcy in recent months or can't afford full rent payments because of COVID-19 restrictions.

Trepp's report shows the MOA's loan was paid through April, with payments on the $1.4 billion mortgage still three months delinquent.

The mall reopened in June and is slowly getting back to normal, with the majority of its stores and its indoor theme park Nickelodeon Universe currently open. Tenant rent collections have climbed from 33% in April and May to 50% in July, according to Trepp.

The MOA's finances are complicated by its owner's other projects.

Triple Five pledged a 49% stake in the Mall of America for its American Dream megamall in East Rutherford, N.J., which hasn't been able to fully open.

Despite the problems, retail experts said they expected lenders to work with Triple Five on a solution for the Mall of America.

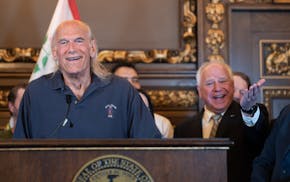

Former Gov. Jesse Ventura boasts he could beat unpopular Trump or Biden if he ran for president

Dave Kleis says he won't run for sixth term as St. Cloud mayor

Newspaper boxes repurposed as 'Save a Life' naloxone dispensaries

St. Cloud house vies for Ugliest House in America