Part one of a two-part series

SAN FRANCISCO -- On the third floor of the historic Folgers Coffee Co. building, just blocks from the city's famed Embarcadero waterfront, Target Corp. is brewing up a storm, and it has nothing to do with caffeinated beverages.

Twenty- and thirty-somethings squint at large Mac screens, lined neatly on long rows of white, benchlike work tables. Scribbled equations and website server stats dot whiteboards and glass walls. A few beanbag chairs sit unused near the center of the room.

The office mirrors the hundreds of technology start-ups that occupy similar digs throughout San Francisco and nearby Silicon Valley. And that's exactly what Target wants for its new Technology Innovation Center, a skunk works-like building that can incorporate the look and feel of Valley-style innovation into its own corporate DNA.

It's among the latest attempts by Target and other traditional retailers to reinvent themselves in the digital age. They are spanning their efforts beyond just their websites and looking afar at ways to cook up the next must-have technology or innovation.

As consumers increasingly entrust their shopping needs to smartphones, tablets and social media, Target is rushing to recruit talent and creativity by establishing innovation colonies in Silicon Valley and other hot spots around the country. The need has become more urgent as store traffic and sales in the United States stagnate and online sales continues to climb each year.

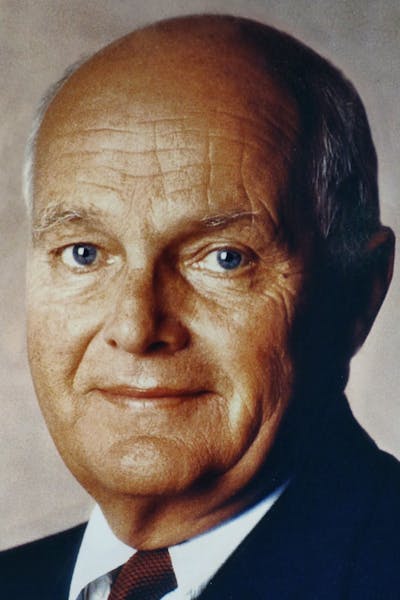

"Retail is undergoing a major revolution," said Beth Jacob, Target's executive vice president and chief information officer. "Technology is key more than ever. It requires us to get comfortable with a test-and-learn [mentality] and innovate faster."

Over the past year, a small army of data scientists, software engineers and IT geeks has explored new technologies that might give the Minneapolis-based retailer a modern digital spin on the basic premise of selling merchandise in a store. Location may still be key to business success, but today's retailers must think of location in relation to a person's smartphone and tablet.

Think about software that allows a customer to photograph a product with a smartphone and get instant offers and product information. Imagine a mobile device that can automatically detect where to find a store that carries particular merchandise based on a user's current location. What if Target can predict your future needs based on your present purchases?

It might seem odd that decades-old retail chains would suddenly try to position themselves as legitimate players in San Francisco. But the pace of technological change leaves retailers with little choice, analysts say.

Wal-Mart Stores Inc. already established its e-commerce headquarters in San Bruno, Calif. Nordstrom and Home Depot also operate technology labs in Seattle and Austin, Texas, respectively.

"They are trying to get closer to the talent," said Carol Spieckerman, president of the newmarketbuilders retail consulting firm. "Not everything can come out of headquarters."

The retailers are scouring universities, venture capital offices and start-up incubators, especially in Silicon Valley, which is experiencing yet another tech boom. Wal-Mart has been on a buying spree of late, acquiring software maker Tasty Labs and cloud computing company OneOps in May alone, which it folded into its innovation center called Wal-Mart Labs.

"You have to be in the [San Francisco] Bay Area," said Marc Weiser, founder and managing director of RPM Ventures in Ann Arbor, Mich., which invests in several Silicon Valley start-ups.

But for Target and others, it remains to be seen whether a Stanford University computer whiz would join a traditional retailer. "Do you think cutting-edge [programmers] are going to work for Target?" Weiser asked.

Meeting with a bang

Target's office in San Francisco is literally a work in progress. A recent briefing was interrupted when the front door suddenly swung open, loudly striking the side of the conference room where the meeting took place.

"New office," spokesman Eric Hausman explained as people laughed.

"Yes, we apparently didn't order doorstops," Jacob joked.

Target has operated in Silicon Valley for years but only recently decided to establish a more permanent presence. Throughout the region, start-ups are hard at work developing pieces of the multichannel experience that retailers desire: mobile payments, maps, social interaction, data analytics.

"We're at the tip of innovation spear," said Nate Swanstrom, Target's vice president of multichannel and marketing. "We are trying to be out in front and really driving the unexplored or underexplored."

More than a year ago, Target decided to partner with SapientNitro, the digital agency that redesigned the target.com website, to set up shop in the Folgers building, an ideal location for tech junkies.

Under the leadership of director David Newman, a former Apple and walmart.com executive, the center has been looking at easier store checkouts, incorporating third-party reviews into target.com, boosting the speed and accuracy of searches, and offering same-day delivery in select markets. Further down the horizon are still-nascent technologies like geo-fencing and image recognition software.

With the former, consumers can receive special offers and product information through smartphones based on their location in the store. So a shopper who walks by flat-screen televisions receives a text describing the new 4G HDTV from Sony.

With the latter, a user can take a photo of a product and instantly receive a link to purchase the item. Or the person's own image can be used as a security key for the consumer to authorize the smartphone to buy merchandise.

"It's just the right time to operate with our own team footprint here in San Francisco," Jacob said.

Wal-Mart Labs is pacesetter

For inspiration, Target's San Francisco staff need look only 12 miles south to San Bruno to see a familiar retailer make it work. Throughout its history, Wal-Mart has perfected the art of reducing costs. But over the past decade, the retailer has become a surprising force in Silicon Valley through its Wal-Mart Labs subsidiary.

"Everyone is trying to copy what Wal-Mart Labs are doing," Weiser of RPM Ventures said.

Housed in an imposing blue glass building just across the street from YouTube's corporate headquarters, Wal-Mart Labs serves as the retailer's skunk works for all things related to mobile, website and social media.

In many ways, the building that houses Wal-Mart is what you would expect of a corporate giant: Tight security in the main lobby and floors filled with colorless walls and unremarkable cubicles. But some flourishes of a start-up also are there: A giant cardboard cutout of Chewbacca stands watch near a pool table and two bright red replicas of British telephone booths.

"We like to think we are one of the biggest start-ups in Silicon Valley," said Dan Toporek, vice president of communications for Wal-Mart global e-commerce.

Most start-ups, though, don't have billions of dollars to spend on acquisitions. In addition to Tasty Labs and OneOps, Wal-Mart in recent years has bought Cosmic Voodoo, a digital streaming service, and Kosmix, which developed a new search engine that tries to determine a user's intent, not just display pages that contain search terms.

Much of the technology Wal-Mart inherited from these acquisitions has already made its way to consumers. Last year, Wal-Mart launched a service that allows consumers to store their DVD content in cloud servers and access it on any device; that service originated from Cosmic Voodoo. Wal-Mart also incorporated Kosmix algorithms in its Social Genome Project, an effort to build a next-generation search engine.

While Wal-Mart likes to say it embraces risk, the company adopts the same disciplined approach to innovation it usually applies to pricing and store operations. While Target officials stress experimentation, Wal-Mart prefers pragmatic creativity.

"We don't try to come up with crazy, out-in-left-field ideas but rather ones that are applicable to business," Toporek said.

Labor in demand

Wal-Mart also is on a hiring binge, trying to snatch up as many engineers and developers as it can.

"You are competing for some of the best talent in the world," Toporek said.

But these days in Silicon Valley, money is hardly enough. A wave of venture capital money and pricey buyouts have once again swept the region, straining an already tight labor market.

"I would liken it to the first dot-com days," said David Knapp, a San Francisco-based regional vice president for technology and creative services for recruiting firm Robert Half Technology. In particular demand are mobile developers, business intelligence specialists and network architects.

According to a recent Robert Half survey, 78 percent of San Francisco-area chief information officers planned to hire in the second quarter.

So how can Target and Wal-Mart compete against "sexier" companies like Facebook, Instagram and Pinterest?

"You have to pitch people on the future," said Nathan Stoll, a former Google executive who co-founded Luvocracy, a social media/e-commerce start-up backed by Yahoo CEO Marrisa Meyer and the renowned Silicon Valley venture capital firm Kleiner Perkins Caufield & Byers.

Target is confident it can do just that, said Newman, the Target center's director.

"Recruiting has exceeded our wildest expectations."

Thomas Lee • 612-673-4113