who will see relief

• Recent college graduates can save up to $190 per year through a student loan interest deduction, and current students can get an increased tuition deduction averaging $140.

• Married couples can save an average of $115 per year with the elimination of the "marriage penalty."

• More than 25,000 families who qualify for child-care tax credits will get an average additional credit of $74 per year.

• Small businesses can offer tax-free tuition and adoption assistance for employees.

• The Working Family Tax Credit will be expanded to include an estimated 16,000 more families, and those already getting the credit will get more relief.

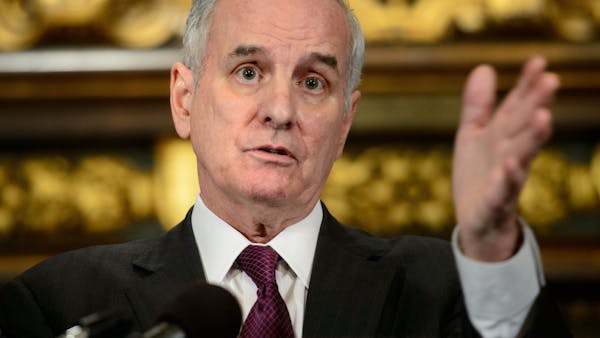

Source: Gov. Mark Dayton's office

More from Star Tribune

More from Star Tribune

More from Star Tribune

More from Star Tribune

More from Star Tribune

More From Star Tribune

More From Politics

Nation

New Black congressional district in Louisiana bows to politics, not race, backers say

Politics and race are both factors in a pending court challenge of Louisiana's new congressional maps. How much weight each carries is a major question before three federal judges whose ruling could affect the balance of power in the next Congress.

Nation

Trump trial jury selection process follows a familiar pattern with an unpredictable outcome

When the first batch of potential jurors was brought in for Donald Trump's criminal trial this week, all the lawyers had to go on to size them up — at first — were their names and the answers they gave in court to a set of screening questions.

Nation

Climate change concerns grow, but few think Biden's climate law will help, AP-NORC poll finds

Like many Americans, Ron Theusch is getting more worried about climate change.

Nation

Senate rejects impeachment articles against Mayorkas, ending trial against Cabinet secretary

The Senate dismissed all impeachment charges against Homeland Security Secretary Alejandro Mayorkas on Wednesday, ending the House Republican push to remove the Cabinet secretary from office over his handling of the U.S.-Mexico border and shutting down his trial before arguments even began.

Nation

Poland's president becomes the latest leader to visit Donald Trump as allies eye a possible return

Former President Donald Trump met Wednesday in New York with Polish President Andrzej Duda, the latest in a series of meetings with foreign leaders as Europe braces for the possibility of a second Trump term.