WASHINGTON – The Janet Yellen era at the Federal Reserve begins in earnest this week with a two-day meeting, a policy statement and fresh economic forecasts. Yet all that will be a prelude Yellen's first news conference as Fed chair.

Will Yellen embrace predecessor Ben Bernanke's approach of keeping rates low while gradually paring the Fed's economic stimulus?

Or, as some speculate, might she favor low rates to try to accelerate job growth, even at the risk of high inflation?

No major announcements are expected when the meeting ends Wednesday. The Fed's most recent policy statement said it planned to keep short-term rates at record lows "well past" the time the unemployment rate falls below 6.5 percent. The rate is now 6.7 percent.

One reason for dropping the threshold, as Yellen among others have noted, is that the unemployment rate can overstate the job market's health. In recent months, for example, the rate has fallen not so much because of robust hiring but because many people without a job have stopped looking for one.

Yellen, who was sworn as chair on Feb. 3, has spoken of seeking continuity with Bernanke, under whom she served as vice chair. That's partly why the Fed will likely announce this week a third reduction in its monthly bond purchases. In December and in January, the Fed cut its monthly pace of bond buying from an original $85 billion in $10 billion increments to $65 billion.

The pullback is expected to occur despite challenges the U.S. economy and financial markets face, from a brutal winter that's depressed growth, to fears about how Russia's aggression toward Ukraine might slow the global economy.

The Fed and most private economists foresee faster economic growth in 2014. Many think the economy, which grew a lackluster 1.9 percent in 2013, will rebound to around 3 percent this year.

More than five years ago, the Fed cut that rate to a record low near zero, where it's remained since. Most analysts think the Fed will keep its target for short-term rates near zero until late 2015.

Participant, studio behind 'Spotlight,' 'An Inconvenient Truth,' shutters after 20 years

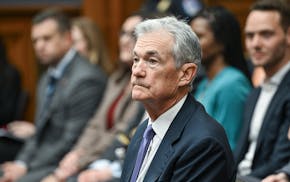

Fed's Powell: Elevated inflation will likely delay rate cuts this year