A federal grand jury on Wednesday indicted two Twin Cities bank officers and a customer for allegedly using a series of fraudulent loans to conceal the customer's check-kiting scheme.

Bankers John Anthony Markert, 57, of Mendota Heights, and Gregory Paul Pederson, 43, of Roseville, along with customer George Leslie Wintz Jr., 61, of Roseville, were charged with five counts of misapplication of bank funds.

According to the indictment, Markert and Pedersen, helped by Wintz, misapplied approximately $1.9 million from Pinehurst Bank in St. Paul from March 6, 2009, through Jan. 29, 2010. Markert was the bank's president and Pederson was the bank's chief credit officer and senior vice president. Wintz is a businessman who owns and controls trucking and warehousing businesses, and was a long-time banking customer of Markert at both Pinehurst and at a second bank where Markert previously served as president.

Check-kiting is a scheme in which someone intentionally writes a check for more than the account balance in one bank, then writes a check from an account in another bank that also has insufficient funds. The second check ostensibly covers the deficit in the first account. In reality, the account balances are falsely inflated, allowing the check-kiter to use the funds to cover payment of other items.

The indictment alleges that Wintz was kiting larger and larger amounts of bad checks between Pinehurst Bank and the second bank until late February 2009, when the second bank discovered the scheme and returned over $1.8 million in bad checks to Pinehurst Bank -- well beyond Wintz's borrowing limit at the bank of $1.25 million.

Allegedly, Markert, Pederson and Wintz then arranged five loans worth $1.9 million to go to straw borrowers, knowing the money was intended to cover the check-kiting scheme.

The indictment alleges that in each instance, Markert and Pederson knew that Wintz, not the straw borrowers, was the actual borrower. In fact, Markert and Pederson allegedly recruited the straw borrowers and were on the bank committee that approved the loans.

The alleged scheme was uncovered during an audit in January 2010 and the bank fired Markert and Pederson. If convicted, the three face up to 30 years in prison on each count.

James Walsh • 612-673-7428

Marijuana's path to legality in Minnesota: A timeline

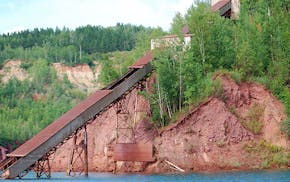

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year