Soybeans have been harvested across the Midwest, but tens of millions of bushels are sitting in bins on farms and at grain elevators.

Unwilling to sell at current prices and hopeful that progress on trade talks with China will be a boost to the market, farmers have decided to hold on to their crop as long as they can.

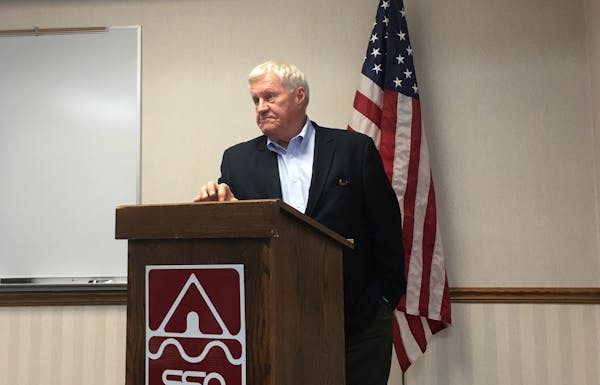

"A lot of soybeans are going nowhere right now," said Bob Zelenka, executive director of the Minnesota Grain and Feed Association.

Prices for soybeans fell on Memorial Day when President Donald Trump signaled his intent to launch a trade war and they haven't recovered. Soybeans are Minnesota's largest agricultural export by far, with $2.1 billion in exports in 2016, more than double the value of exported corn. U.S. farmers went into the harvest with their largest stockpile of soybeans in 12 years. A survey in September showed they were storing about 438 million bushels, 45 percent more than a year earlier.

Newer data isn't yet available from the U.S. Department of Agriculture, but farmers and soybean shippers say farmers are storing far more beans than usual.

Tim Velde, a farmer in Hanley Falls, said he sold about 40 percent of his soybeans on the futures market earlier this year at slightly better than break-even prices. The remaining 60 percent are in storage, some at his farm and some at the local grain elevator.

"It's at a point where I can't afford to sell them, because I can't take that much of a loss," said Velde, who raises corn and soybeans.

Dennis Inman, vice president of grain at Central Farm Service, which runs grain elevators across south central Minnesota, including one just north of Randolph, said typically farmers sell soybeans after the harvest and store their corn.

That's because soybeans are a higher-dollar crop — $9.10 per bushel compared to $3.72 per bushel for corn — and therefore help a farmer get financially prepared for the next year's planting.

While soybean farmers are some of the key beneficiaries of the USDA's assistance to farmers affected by the trade war, receiving 82 cents per bushel for their harvested crop so far, that hasn't been enough to get farmers to sell.

"Normally, I sell a majority of my soybeans off the combine, and then I would wait for a corn rally," said Bryan Klabunde, a farmer near Waubun, Minn. "I would probably be 75 to 85 percent sold on my soybeans right now."

Instead, he's holding on to half of his recently harvested soybeans.

Minnesota has about 600 million bushels worth of storage capacity at grain elevators and another 2 billion bushels on farms, where farmers have been building more and more bins over the past 20 years.

The state's storage capacity has not been filled yet, in part because last year's rainy spring and early summer kept corn yields down.

"We've got room to spare, we've got room to put away the crop, and that's a good thing because the farmer has been reluctant to sell at current price levels," said Inman, of Central Farm Service.

That storage capacity is a nice shock absorber for Minnesota farmers, but they can wait only so long to convert their beans into cash, since bankers need to see income before they can extend loans for 2019.

"Farmers need operating money. That's the problem with storing," said Thom Peterson, government relations director for the Minnesota Farmers Union. "The whole idea is you need to sell that to pay your bills, to pay your loans. That's where a lot of farmers are going to run into problems."

Klabunde, the farmer near Waubun, said time is running out as bankers seek payment on last year's operating loans.

He added that a record Brazilian soybean crop is predicted, no trade deal with China is in sight and, even if it were, there's little confidence that a deal would quickly lift soybean prices to a healthier level of around $10.50 a bushel.

"Everyone's trying to hold on as long as they can," Klabunde said. "But the financial institutions are going to have a lot to say about how long they can."

Closing prices for crude oil, gold and other commodities

Thai plastics firm will pay $20 million to settle with U.S. over Iran sanctions violations

Biden administration moves to make conservation an equal to industry on US lands

Stock market today: Wall Street limps toward its longest weekly losing streak since September