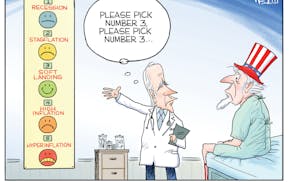

The baby boomer generation's sway at the Minnesota statehouse has been evident since legislators began beefing up school funding in the 1950s. It's visible again this year in a number of proposals to exempt both Social Security and military pension income from the state income tax, advanced by both GOP and DFL legislators.

The political lure of such tax breaks is potent. In recent years, the millennial generation overtook the boomers as the state's largest age-based cohort, with 28 percent of the population compared with 25 percent. But boomers still vote in greater numbers than any other generational subset, and likely will for the next decade or two.

Still, we hope Minnesota politicians will not be led into the temptation of a fat tax break for seniors or for military pensioners, some of whom are still in their prime earning years. And we urge younger Minnesotans to listen up when legislators talk about aiding their elders in this fashion. These proposals would shift a larger share of the cost of government onto younger shoulders — and those shoulders already bear a heavy load.

Proponents of a Social Security exemption press their case on two fronts: competitiveness and the unfairness of "double taxation." Neither argument can withstand close scrutiny.

Minnesota taxes Social Security benefits in the same way the federal government does. It already exempts the full benefit for low-income recipients, singles with total incomes of less than $32,542 and couples with total incomes below $44,390. How much Social Security income is subject to being taxed increases past those thresholds, but never exceeds 85 percent.

That tax structure represents federal recognition that some portion of a beneficiary's Social Security check can be said to be derived from FICA taxes paid during the beneficiary's working lifetime — but it is a small portion. Employer contributions, interest earned by the Social Security Trust Fund and FICA taxes paid by today's workers account for more. That reality undercuts claims that Social Security has already been taxed once and should not be taxed again. And the existing exemption for low-income seniors means that middle- and upper-income taxpayers stand to be the sole beneficiaries of a bigger state tax break.

Senior out-migration is the other oft-cited reason to spare Social Security income from taxation. Other states that don't tax Social Security benefits (see accompanying text) will be a magnet for Minnesota's elders, it's said.

Plenty of anecdotes back that argument. Demographic data do not. Two economists, Karen Smith Conway of the University of New Hampshire and Jonathan Rork of Reed College, used several methods to answer the question, "Do state tax policies drive away the elderly?" Their conclusion, published in the National Tax Journal in 2012: "Our results are overwhelming in their failure to reveal any consistent effect of state income tax breaks on elderly interstate migration. … State tax policies towards the elderly have changed substantially while elderly migration patterns have not."

Proposals to spare military pensions from taxation pluck at different heartstrings than the Social Security exemption does. America's fighting forces have sacrificed much in the last decade and deserve tangible thanks. In that spirit, Minnesota has provided military retirees and disabled veterans with an income tax credit of $750 per year since 2008.

Is more warranted? Perhaps. But it should not be offered with an expectation that it would lure more retirees as residents. An analysis by House Research compared Minnesota's experience in attracting military retirees with that of surrounding states that exempt military pension income from state income taxes. The growth in that population was nearly identical among the comparison states, regardless of their tax policies.

But the best reason to reject both of these tax breaks goes to the heart of shared citizen responsibility for this state, something dear to the hearts of those who have served this country. In a democracy, the duty to pay for government should be widely and equitably shared.

The military pension exemption carries a $25-million-per-year cost to the state treasury. The several Social Security exemption bills introduced at the Legislature call for a phase-in over varying numbers of years. If a phase-in were to be complete by 2018, it would take $500 million out of state coffers that year and a good deal more in subsequent years. That's a sweet break for middle- and upper-income boomers. But it would mean reduced state services or higher taxes for younger Minnesotans, and that's not fair.