Most Minneapolis homeowners should get a breather on their property tax bills next year.

School officials are recommending a freeze in their levy that will be considered by the school board Tuesday. That comes atop Hennepin County earlier setting a maximum levy increase of 0.9 percent, and the city of Minneapolis capping next year's levy at 1 percent less than it's collecting this year.

"If your home value didn't go up, then your property taxes are not going to go up," said Jack Qvale, executive secretary of the municipal Board of Estimate and Taxation. Final levy votes will occur in December.

Properties where rising assessments outpace the market could still see increases, but homes that lost value or didn't gain will do best. Owners will get a glimpse of their potential bills when the county mails so-called "truth in taxation" notices in mid-November.

The Legislature helped each of the big three participants in the tax bill to moderate its property tax take. The city is getting back a major chunk of the aid it lost to state budget cuts in 2003. The county got more aid for its programs and shared in a new exemption from sales taxes. Schools got state aid in converting some of the levy approved by voters in a referendum to levy set by the board.

The school levy is the third leg of the 2014 property tax bill to fall into place. The levy isn't growing for two main reasons. The school district got $2.7 million in increased state aid for its levy conversion, and it hasn't been using all of its levy authority in recent years, so it has less.

One reason it hasn't used its full authority is that it has been paying off debt incurred for routine maintenance and keeping up building systems faster than it has borrowed. Moreover, the board last year balked at raising the levy by a staff-proposed 7.4 percent, substituting a 4 percent increase.

The proposed levy remains flat despite additional taxation recommended for helping to finance the district's planned entry into the state's Q-comp alternative teacher pay program. That's more than offset by more state aid that would subsidize some of the district's current costs for evaluating teachers and other expenses. The drop in the district's debt would be erased soon under a proposal to start borrowing $40 million annually to finance a capital improvement program that hasn't yet been unveiled. That money would be earmarked for improving and expanding district buildings in four areas: keeping up with expanding enrollment, meeting additional regulatory requirements, making security improvements and air-conditioning buildings that lack that.

If the board adopts the proposed levy for next year, Chief Finance Officer Robert Doty projects a 3.4 percent increase for 2015 taxes and a 2.1 percent increase for 2016.

Steve Brandt • 612-673-4438

Twitter: @brandtstrib

Marijuana's path to legality in Minnesota: A timeline

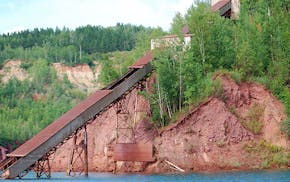

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year