State officials addressed a glaring shortage of health insurance choices for Minnesotans in Rochester on Wednesday by announcing the addition of seven new Medica plans for them on the MNsure exchange.

The move doubles the number of insurers offering plans through the online exchange to residents in urban ZIP codes of Olmsted and Dodge counties, but it doesn't solve the affordability problem confronting southeastern Minnesota.

"Minnesotans, regardless of where they live — Rochester, Duluth, Eveleth or the Twin Cities, and everyone across the state — deserve choice when purchasing health insurance coverage," said Minnesota Commerce Commissioner Mike Rothman, whose agency approves all plans before they are sold on the exchange.

When MNsure debuted this month, many insurers balked at offering coverage in ZIP codes where Mayo Clinic is the dominant health care provider. Mayo can command higher rates for services — which often translates into higher premiums. While Blue Cross and Blue Shield of Minnesota offered one plan in Rochester, residents complained that it would cost hundreds of dollars more per month than their current private plans.

One Rochester couple seeking coverage through MNsure found no affordable options last week, said Dave Ellingson, a local broker who assisted them. "Based on what was in the MNsure system, it was going to be a lower deductible than what they had, but the [overall] cost was actually more expensive."

Even with the addition of the Medica options, however, Rochester residents will be picking among the most expensive plans on the exchange.

A Star Tribune comparison of MNsure plans — using a fictional family of two 40-year-old, nonsmoking parents with children ages 10 and 5 — shows the disparity. If this family lived in the Rochester ZIP code of 55901, right now they would have only the choice of a Blue Cross plan with a $6,000 deductible and a monthly premium of $1,087.64.

If the family lived just to the east, in the Eyota ZIP code of 55934, they would have that same option. But they would also have seven options from Medica, with premiums ranging from $858.10 to $1,310.08.

As part of the Medica deal announced Wednesday, Rochester residents will gain access to these seven plans. MNsure officials expect them to be online as soon as next week.

Even so, the cheapest plan in Olmsted County would rank as one of the most expensive in the Twin Cities — where premiums have been described as some of the lowest nationally under the federal Affordable Care Act. If this fictional family of four lived in the suburban Twin Cities ZIP code of 55441, they would have 51 plan options, with premiums ranging from $391.16 to $947.88.

The addition of the Medica plans addresses access and choice for Rochester residents, but not the high cost, acknowledged Dannette Coleman, Medica's vice president and general manager of individual and family business. "Those are really two different issues," she said.

'We wanted to be there'

The higher cost in Rochester won't matter to lower-income families or individuals who qualify for premium subsidies under the Affordable Care Act. That's because the subsidies are designed to cap the share of income any family pays for health care; so if qualifying families in Rochester pay higher premiums, they often will receive more generous subsidies. People who don't qualify for subsidies, though, will pay the full cost of the expensive plans.

Medica didn't offer a MNsure plan in Rochester until now because its network lacked local doctors in key specialties such as thoracic surgery, Coleman said. The Minnetonka-based insurer has since worked out a deal with state officials to make sure those services will be provided.

"We wanted to be there and the state wanted us to be there," Coleman said.

One quirk in the new Medica offerings is that they do include Mayo Health System doctors — none of whom are located in Rochester — but not the Mayo Clinic or its network of doctors in the city. As a result, Rochester patients who want in-network care at the Mayo Clinic itself in many cases will need to drive out of town to Mayo Health System doctors, who can refer them back to the Mayo Clinic for specialty or hospital care. (The exception is when Medica doesn't have providers in its network for covered services. Then patients can receive in-network care at Mayo for those services.)

The Blue Cross plan includes the Mayo Clinic.

Ellingson said Medica's limited network presents some pitfalls — for example, if patients needed emergency care from an out-of-network clinic or hospital.

Ellingson's brother, Mark, also a broker, said the MNsure issue has exposed the high costs and lack of plan choices that have worsened in the Rochester area.

"Existing clients are frustrated on two fronts," he said, "the first being that costs are escalating and most people are not seeing a reduction in premium costs as had been touted by the Affordable Care Act. The second is they are now realizing more than ever that southern Minnesota truly does have a lack of health insurance options."

Jeremy Olson • 612-673-7744

Legendary record store site in Minneapolis will soon house a new shop for musicheads

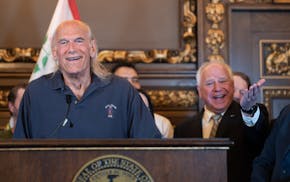

Former Gov. Jesse Ventura boasts he could beat unpopular Trump or Biden if he ran for president

Dave Kleis says he won't run for sixth term as St. Cloud mayor

Newspaper boxes repurposed as 'Save a Life' naloxone dispensaries