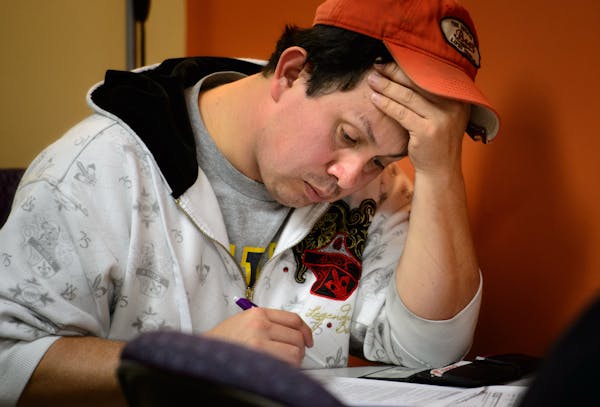

After a halting start that left thousands of Minnesotans pulling out their hair in frustration, MNsure officials said Tuesday they exceeded their goals for the initial open enrollment period.

"I think it's fair to say MNsure has turned a corner," interim CEO Scott Leitz said.

Nearly 170,000 Minnesotans signed up for insurance coverage through MNsure, the state's new online insurance exchange, according to preliminary figures. That's well above the 135,000 the agency set as a target last October, a few weeks before the website and call center came unglued with technical glitches that lasted through the end of the year.

But the crush of traffic and faltering functionality on the federal health care Internet site left about 36,000 Minnesotans who had tried to enroll through MNsure without coverage as the midnight deadline passed Monday.

It's too soon to know how many of those having trouble were trying for the first time to sign up. MNsure staff members will spend the next month resolving problems and arranging retroactive insurance coverage for those who "did their level best" to buy coverage, Leitz said.

As the first major chapter closes under the new federal health care law, Minnesota and the rest of nation are about to undergo the largest expansion of health coverage since the passage of Medicare and Medicaid in 1965.

An unanswered question is how many of the state's 445,000 uninsured have gotten coverage under the health law, which mainly focused on making health care more affordable for those who don't get coverage through their jobs or for small businesses.

Some people likely purchased health insurance without using MNsure, even though it was the only place for individuals to access federal tax credits that could lower the monthly premium cost.

MNsure reported that about 47,000 enrollees purchased private insurance on the exchange, an important benchmark that Leitz said will give MNsure a sufficient financial cushion to meet the preliminary budget goals submitted to the Legislature in March.

Sales of private plans will provide a key revenue stream in 2015 and beyond, when MNsure must be self-supporting. To date, the agency's operations have been funded entirely by federal grants.

Upwards of five times more people than projected enrolled in Medical Assistance, the state's version of Medicaid. Human Services Commissioner Lucinda Jesson attributed that to the work of navigators and other outreach workers, and to the state's decision to expand the program to include single adults without children.

About 88,000 people were enrolled in Medical Assistance and about 34,000 in MinnesotaCare.

"Good health insurance matters to everyone, particularly for families living on the edge — for the poor and for the working poor," Jesson said Monday. "People without insurance face medical debt, often skip preventive and wellness checks, and end up in expensive hospital emergency rooms."

Consumers who failed to buy insurance by the March 31 deadline will need to wait until Nov. 15, for coverage that begins in January.

There are exceptions for people whose existing insurance coverage changes, such as by changing a job, moving to a new state, getting married or divorced, or having a baby.

Small-business owners with at least one employee and anyone eligible for Medical Assistance or MinnesotaCare, the state's public health programs for low-income residents, can enroll at any time.

Gov. Mark Dayton heralded the success of the MNsure insurance exchange and the federal health law, under which insurance companies can no longer deny coverage for pre-existing conditions and must pay for preventive health services such as cancer screenings and immunizations.

"MNsure has made major improvements in its functionality and customer service during the past three months," Dayton said in a statement. "More work lies ahead to continue those improvements. However, MNsure has now demonstrated its capacity to improve the lives of many thousands of Minnesotans by offering them access to better health care at more affordable costs."

Consumers dialing into the MNsure call center on Monday experienced average wait times of more than 20 minutes. Operators handled more than 28,000 calls, according to MNsure, seven times a typical day.

The website had no system outages, Leitz said, but consumers nonetheless hit snags. He blamed "intermittent" problems with the federal hub, which the MNsure system uses to verify eligibility for federal tax credits and public programs.

Though detailed demographic information isn't yet available, Leitz said a last-minute push to sign up younger people seemed to make a difference, and that about a quarter of those enrolled in private plans were 19 to 34 years old.

Leitz said that 35 percent of total enrollment came in March, when MNsure led a statewide effort of 1,000 enrollment events. About 95 percent of people have paid their first month's premium, he said.

Critics of MNsure and the federal law were quick to find fault, with enrollment projections that originally ranged from 164,000 to 270,000 as the Legislature was debating a bill last year to create MNsure.

"With Obamacare open enrollment closed, it's clear Gov. Mark Dayton and Democrats' law just doesn't work in Minnesota," Rep. Greg Davids, R-Preston, said. "The proof is in the numbers: the architects of Obamacare in Minnesota said as many as 270,000 Minnesotans would enroll on a commercial individual plan in 2014 and as of today, they announced they've fallen 83 percent short of their projections."

Jackie Crosby • 612-673-7335