The foreclosure rate in the Twin Cities metro is at an all-time low and is now one of the lowest in the U.S.

It's a development, however, that's partly the result of underlying troubles in the housing market: a shortage of listings and tight credit.

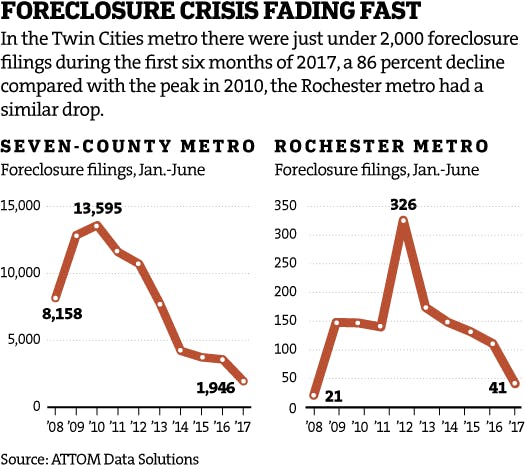

During the first half of the year, the foreclosure rate in the seven-county metro fell 44 percent to just 0.17 percent, according to a midyear report from Attom Data Solutions. During that time, just 2,384 households received a foreclosure-related filing such as a default notice, scheduled auction or bank repossession. That ranks the Twin Cities 183rd among 217 metro areas tracked by Attom.

"With a few local market exceptions, foreclosures have become the unicorns of the housing market: hard to find but highly sought after," said Daren Blomquist, a senior vice president and spokesman for Attom.

It's a dramatic shift for a housing market that just a few years ago was drowning in heavily discounted property listings, creating a wide range of problems including depressed prices.

The situation was at its worst in 2010, when 15,306 households received a foreclosure filing.

In the Rochester metro area, just 41 foreclosure notices have been delivered so far this year. That puts the foreclosure rate in the region at just 0.05 percent, the third-lowest ranking in the nation.

Rochester is home to the Mayo Clinic and has a diverse, stable economy that has largely been immune to much of the volatility that other areas experienced before and after the recession of 2007-09. That means house prices also haven't been as volatile, said Jeff Byrd, broker at ReMax Results in Rochester.

Fewer risky loans

Byrd also said that because Rochester is a relatively small, close-knit community there's been very little predatory lending and risky loan-making, practices that helped trigger the foreclosure crisis in the first place.

"That didn't happen in Rochester," Byrd said. "People just didn't do loans that weren't right."

Nationwide, just 0.32 percent of all housing units had a foreclosure filing in the first half of 2017, a 20 percent decline from the same period a year ago.

During that period, 203,875 properties started the foreclosure process, the lowest six-month total since the second half of 2005, the earliest data available. Attom said only 28 of the nation's 217 metro areas saw an annual increase in foreclosure activity during the first half of the year.

The foreclosure stats are the lowest since Attom began tracking them in the mid-2000s.

Rock-bottom rates suggest that listing inventory of both traditional and distressed properties (foreclosures and short sales) is dangerously low, leading to the purchase of even the most distressed property listings.

The situation is also a sign that mortgage underwriting may be too strict, keeping out prospective buyers.

"There's a trade-off," Blomquist said. "You don't want lending too loose so that you introduce too much risk to [the] market and too many foreclosures, but if your credit is too tight only a very select few people can afford to buy or qualify to buy."

Jim Buchta • 612-673-7376