The first of several federal fraud trials involving Twin Cities chiropractors accused of taking advantage of the state's no-fault auto insurance law to bilk insurance providers is now in the hands of jurors.

The medical necessity of services provided by Preston Forthun's Comprehensive Rehab clinics factored heavily in closing arguments Thursday in Minneapolis. What defense attorneys called a billing dispute was instead described by prosecutors as one of multiple yearslong multimillion-dollar fraud schemes across the metro.

"This is about money," Assistant U.S. Attorney Amber Brennan told jurors on Thursday. "This is not about patient care."

Prosecutors accused Forthun and a partner who helped run two Lake Street clinics of earning more than $3 million between 2010 and 2015 by billing for allegedly unnecessary treatments to patients who were paid to attend up to 40 appointments each. Also on trial is Abdisalan Hussein and Carlos Luna, two men who allegedly served as "runners" to recruit and pay accident victims to attend Comprehensive Rehab for treatments. Prosecutors say 90 percent of Forthun's business came from runners paid more than $500,000 over six years.

All three are charged with conspiracy to commit mail and wire fraud, plus additional individual fraud charges. On Thursday, their attorneys mounted a defense that outlined broad government overreach and anemic evidence. Andrew Birrell, a lawyer for Forthun, described a chiropractor who served as an expert witness as a "disaster" and "such an idiot" for not reviewing patient files for potential wrongdoing.

"I hate to say names but this is the guy they want to use to convict my client," Birrell said. "This is not America, man. This is not my America."

"If you're accusing a doctor of not providing medically necessary treatments, some other doctor ought to look at what he did," Birrell said. "In this case, [prosecutors] couldn't meet any standard of proof. None. They just didn't do their work."

The trial has garnered attention from both the Minnesota legal and insurance communities. The 10-day trial began Sept. 27 before U.S. District Judge Michael Davis, who is also overseeing related cases against more than two dozen defendants accused of defrauding the state's no-fault auto insurance law.

The law mandates minimum coverage of $20,000 for medical expense benefits and other financial losses regardless of fault in a crash.

According to charges, chiropractors paid alleged "runners" about $1,000 to $1,500 per adult patient they recruited and about $750 for child patients after patients attended between six to 12 visits. Runners then gave most of the money to the patients, who were also allegedly referred to injury lawyers and told that more treatments would help their chances of receiving a large settlement from insurance companies.

At trial, prosecutors relied on testimony from Forthun's former business partner, Darryl Humenny, a chiropractor who pleaded guilty to conspiracy and agreed to cooperate with authorities earlier this year. Humenny testified last week that Forthun introduced him to the practice of paying runners to bring clients to their clinics.

Most clients were Somali or Latino, Humenny said, and clinics like Comprehensive Rehab had a reputation for doling out cash for accident victims to receive treatments.

On Thursday, Brennan said Forthun sought to conceal his use of runners from insurance companies because they would not likely pay for the clients with that knowledge. But RJ Zayed, an attorney for Hussein, cited testimony from multiple insurance representatives who said they still would have approved claims for patients who received treatments deemed medically necessary.

Zayed argued that prosecutors failed to provide evidence that any client received unnecessary treatments, or that the clinics billed for services never rendered, as alleged in the indictment.

"The fundamental thing for there to be a fraud is there has to be lying, cheating, stealing and taking somebody's money," Zayed said. "Something has to be taken from the insurance companies. What did they show you was taken from insurance companies? Nothing."

Among those watching the case with interest has been Jack Davies, a former DFL state senator who authored Minnesota's no-fault law more than 40 years ago.

"When we were drafting the No-Fault Act it was a semi-joke — and semi-serious — that we were worried about 'rehabilitative guitar lessons' and that kind of thing," said Davies, who is also a retired state appellate judge. "We were never worried about the corruption of licensed medical providers. We figured the licensing boards would take care of that."

Stephen Montemayor • 612-673-1755

Twitter: @smontemayor

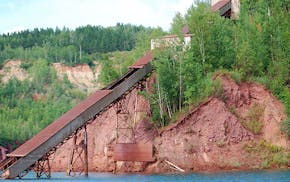

Minnesota to close state park on Iron Range, turn it back into a mine

Marijuana's path to legality in Minnesota: A timeline

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year