"It's déjà vu all over again," President Obama said a few weeks ago about a pending spike in student loan interest rates that, despite his warning, came to pass on Monday. The rate doubled from 3.4 percent to 6.8 percent for federally subsided Stafford loans — the ones that go to students most in need of help paying for college.

Like the president, we see a sorry pattern. What happened to subsidized Stafford loans is the latest incident of Congress allowing clumsy, autopiloted austerity measures to fall hardest on those least able to cope with the change. Subsidized Stafford loans, 70 percent of which go to students from families with annual incomes less than $50,000, are now on the same roster of shame as sequestration's cuts earlier this year to Head Start, Meals on Wheels and long-term unemployment benefits.

The shame in this case is compounded by the fact that student loans aren't adding to the national debt. The government is making money on them — $50.6 billion in fiscal 2013 alone, according to the Congressional Budget Office.

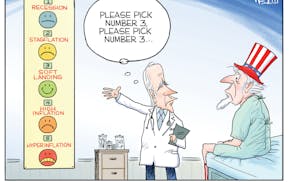

If Washington's all-too-familiar pattern holds, Congress will spend the next several weeks pointing partisan fingers of blame, but will do nothing to ease the burden that inaction places on low-income students and their families.

That would be a reproachable result — but not because of an immediate problem. None of the students affected by Monday's change should double down right away on a diet of noodles and rice. No one already repaying Stafford loans will pay more. The rate hike falls only on new loans, and the government pays their interest costs while students are enrolled in college.

When study ends and repayment starts, the higher interest rate will add an estimated $761 to the 10-year debt service for each year of an average Stafford borrowers' loan, or $3,044 for borrowers who took out four years of average-sized loans, according to the Student Loan Network. Even then, the federal tax deductibility of Stafford loan interest eases their burden for many borrowers.

But the message Monday's interest increase sends to students and their families is the wrong one. High borrowing costs are a deterrent to college participation among the very students the nation should most want to see enrolled. A daunting debt load can be among the reasons for low-income students to decide that college isn't for them.

Convincing them to choose otherwise is in the national interest. Economists see a shortage of skilled workers looming that would ease if more lower-income young people went to college. Their enrollment rate badly lags that of affluent young adults. According to Minnesota-based College Possible, American young people with family incomes in the top quartile have an 80 percent chance of attaining a four-year degree by age 24. By comparison, only 8 percent of those with family incomes in the lowest quartile obtain a four-year degree within six years of high school completion.

Smart, strategic national policy would employ student loan interest rates as one of several tools for increasing college participation among less-fortunate Americans. Monday's big rate bump is policy of the opposite kind.

In his role as chair of the House Education and the Workforce Committee, Minnesota GOP Rep. John Kline has been a leader in seeking a better approach. The bill he carried to May 23 approval on a near-party line vote isn't entirely salutary. It would peg interest rates on Stafford loans to the 10-year U.S. treasury interest rate, and would allow that rate to vary over the life of the loan, up to a fixed cap of 8.5 percent. The result this year would be a new Stafford rate of 4.4 percent.

Democrats fault Kline's bill for a cap that's too high and that allows for too much year-to-year rate fluctuation. We think its chief flaw lies in assigning the same interest rate to both subsidized and unsubsidized Stafford loans. Unsubsidized Stafford loans reach far into the middle class, a population already enrolling in college at a healthy clip. The case for a discount on subsidized Stafford borrowing is much stronger.

Kline has been reaching for compromise, but Democrats haven't done enough reaching back. The White House and Senate Democrats have floated several ideas, but haven't coalesced around one. A Senate bill to extend the 3.4 percent rate for two years faltered two weeks ago with 51 votes (60 were needed to break a Republican filibuster). Some version of an extension is expected back on the Senate floor next week.

We'll cheer an extension if it is crafted as a bridge to a comprehensive overhaul of student loan policies that tailors them to clear higher-education objectives. Such an overhaul should be a component of the reauthorization of the federal Higher Education Act, which expires at the end of this year.

Minnesota Democratic Sen. Al Franken, who sits on the committee that oversees higher education policy, says he favors an extension of the 3.4 percent rate precisely to allow time for that kind of overhaul to emerge. Minnesotans should urge him and other members of the state's delegation to make student loan reform a priority whether or not the 3.4 percent rate returns.