About a week ago, I was finally able to come up for air after a busy holiday season and finish our business' 2010 profit and loss statement and balance sheet. The completion of that was timely due to the fact that the corporate income tax deadline is March 15. So it should be of no surprise that all of the recent bantering about state and federal budget deficits, proposed changes in the tax levies, revenue projections, union busting and other political gamesmanship is of particular relevance to those of us preparing to meet our obligations under the current corporate tax codes.

Our elected officials and those with vested interests would have us believe all sorts of nonsense when it comes to taxes. On the one hand, there are those who say that all taxes are bad and that raising any tax is detrimental to society especially at a time when we as a country are struggling to right ourselves after the worst financial crisis since the Great Depression. I refer not only to the vast majority of those who identify themselves as Tea Partiers, but also to people like State Republican Chair Tony Sutton who, while not elected directly in anyway by the voters, feels he is justified in trying to bully his caucus into refusing to discuss any sort of ideas for increasing state revenues. We can only be thankful that not every Republican in the State Legislature is so feckless as to be easily intimidated by him. On the other hand, we have those who are not just satisfied to maintain the status quo but would prefer to increase the tax burden without seriously examining the current tax codes for fairness or for effectiveness in stimulating business investment and job growth.

The current fiscal crises that are facing nearly every state in the union have prompted both ends of this spectrum to exploit people's fears and anger in order to expedite any number of politically motivated agendas. The most obvious example is Wisconsin Governor Scott Walker's attempts to tear down the unions representing most of Wisconsin's public employees. He is right in asking for them to give up what was an inordinately sweet deal that had them contributing nothing to their extremely generous benefit package. In the face of current and future realities, the entitlements are unsustainable. They need to be adjusted in a common sense way. The union members have not debated this nor have they contested it. They are willing to pay into the programs that are in place for them in order to sustain those programs. Walker, on the other hand, is not satisfied with that. He not only wants to eliminate the unions' abilities to collectively bargain, but he also wants to restrict their abilities to collect dues while forcing them to be recertified by their members every year. He is essentially stripping the unions of any relevance they have in representing the rights of workers.

Make no mistake about it. This is blatant union busting. It is an attack on the middle and working classes, and it is a direct assault on the base of the Democratic Party launched from the bully pulpit of the Governor's chair. It is interesting to note that both firefighters and police officers are exempt from this attack. They are, however, wise enough to realize that if he is successful in this that it might only be a matter of time before they are facing the same assault.

So far, the strategy has been relatively simple. Pit the 93% majority of all working people in the private sector who are not represented by unions against those in the public sector who are union members by vilifying those who instruct their children, maintain their roads and provide human services to them instead placing the blame on those who actually created the financial crisis in the first place.

Columnist Katherine Kersten, in the pages of this very newspaper extolled this very approach by claiming that powerful unions (Feel free to insert united working class people here.) contribute abundantly to political campaigns to elect representatives with whom they then negotiate for labor contracts. She insists the well is poisoned. Apparently, it is fine with her if the Koch brothers (Feel free to insert rich and powerful corporate interest here.) do the same thing in order to elect representatives with whom they then work to relax environmental regulations, lower their tax rate, supply government incentives and restrict the minimum wage. These people are not seeking a level playing field, and they are trying to manipulate those who have the most to lose by setting them against one another.

So instead of meaningful discussion about how to create a tax code that best addresses the fiscal crisis while encouraging both long and short term economic growth, we have grandstanding by both sides of the aisle that is designed to address nothing but special interests.

James Madison wrote in the preamble to the United States Constitution that the purpose of the document was to "...promote the general Welfare and secure the Blessings of Liberty to ourselves and our Posterity..." Taxes are one way the government does this by providing the revenue necessary to accomplish these things. The sometimes unfortunate reality of a tax is that it tends to discourage whatever behavior is being taxed. Income taxes are not just a tax on earnings but are also a tax on savings. Isn't saving money something that we would like to encourage? Sales taxes discourage spending, but the primary force behind a growing economy is consumer spending.

Here's where it gets tricky. By taxing behaviors that are positive, the government raises revenues but discourages economic growth by discouraging those very things that contribute to that growth. By taxing property, the government raises enormous amounts of revenue but discourages private ownership. Why not rewrite the tax code putting less emphasis on taxing positive behaviors and putting more emphasis on those behaviors we know to be negative? If we want to discourage smoking, raise the tax on cigarettes. Not only do we raise more revenue, but we also gain the benefit of decreased health care costs. If we want to decrease carbon emissions, raise the gas tax and place a general tax on industries producing those emissions. Not only do we increase revenue, but we gain the benefits of a cleaner environment, overall better health in the general public and quite possibly increased investment in alternative forms of energy which would help free us from our dependence on foreign oil. People will likely drive less thereby putting less stress on our highway and bridge infrastructure. It would also encourage housing density which would contribute toward a reduction in even more carbon emissions.

Former Minnesota Governor Tim Pawlenty raised one state tax while in office. He might have called it a "health impact fee", but it was a sales tax on cigarettes. I applaud him for that. However, it was necessary to override his veto in order to increase the gas tax. The Republican legislators who were brave enough to vote for that override were soundly excommunicated from their party. Not only should they have been joined by their colleagues, but they should have been given leadership roles.

My wife and I are partners in two corporate entities. One is an LLC that is the company that owns the real estate that houses our business. The other is a Subchapter S-Corporation that is the business. The S-Corp was created with the intention of encouraging small business growth and investment by allowing small businesses to be taxed on income in the same manner as an individual earner. That rate is currently lower than the corporate tax rate. That structure works great for most shareholders when the business is cash flowing while posting a net loss on paper reflected in the yearly depreciation of assets and in the calculation of amortized expenses. When that occurs, shareholders who are active participants in the day to day operations of the corporation are able to deduct any corporate losses as personal losses on their individual tax returns effectively decreasing their personal income tax liabilities. It doesn't work so well when the depreciation and amortization expenses are exhausted and the business is realizing an actual net profit. In that case, all shareholders, not just active ones, must claim the corporate profits as personal income whether or not that income is in the form of cash dividends or just an increase in the company's bank balance. It's essentially a double tax. The corporation is taxed on profits while the shareholders are also taxed. Consequently, if an investor in an S-Corporation is not an active participant in running the business that investor realizes no benefit from a net loss. However, that same investor increases his or her tax liability once the business is showing a profit even if the investor receives no cash payment in the process. It doesn't take a genius to realize that this scenario discourages investment by those who would help fund the start up of a small business in which they have no intention of actively participating.

As Minnesota state tax codes go, the state sales tax is a convoluted mess of contradicting documents that sometimes penalize smaller entrepreneurial activities in favor of large companies many of which are out of state. For instance, we opened a market adjacent to our restaurant and created our own proprietary food label with the intention of buying the ingredients for those items from small local farmers. The idea was to increase our purchasing while keeping as much of that money in our local economy as possible. In addition, it created something that has the potential to be a much larger business in the future. We were also creating additional jobs. Issues arose when I investigated the state sales tax code for those items that we intended to sell. It turns out that any food item that we package ourselves that possesses more than one ingredient is subject to sales tax. There are exceptions for meat and bakery items that resulted from lobbying efforts on the parts of those industries, but any canned item, such as sauerkraut for instance, is subject to that tax thereby increasing the cost to the consumer. If we buy a can of sauerkraut made in California and place it on our shelf, there is no sales tax applied. In addition, if someone buys a pound of duck liver terrine and a baguette from our deli while requesting a knife and fork in order to be able to enjoy them later at the office, we must apply sales tax. Once again, it doesn't take a genius to understand that a tax code like this discourages entrepreneurial investment and the purchasing of local food stuffs while promoting the loss of local farm revenue, reducing job creation and driving potential customers to other venues.

Isn't it time that we insist that our elected officials stop all the grandstanding, posturing and public displays of so called actions in the best interest of the public and begin to truly examine what changes would best benefit us all by staying true to those words found in the Preamble to the United States Constitution. I am encouraged by Governor Dayton's willingness to look at all ways in which we may promote job growth and increase investment in our state, and I am also encouraged by the Republican majority's willingness to examine the tax code in order to find ways to increase revenue that will benefit us all in multiple ways. Eliminating wasteful spending is an important piece of the puzzle that will return us to prosperity, but revenue growth and job creation are even more important in that endeavor. Minnesotans must look forward and not backward if we are to progress. Knee jerk reactions, finger pointing and politics as usual will not save us. It is time for creative thinking and positive public policy. Let us hope that our government is up to challenge, but let us hold them accountable to meet that challenge.

Marijuana's path to legality in Minnesota: A timeline

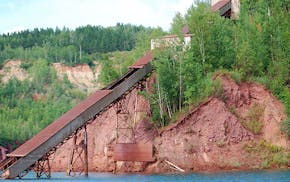

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year