Editor's note/update: After the conclusion of civil contempt proceedings, Andrew Grossman and Fannie Mae negotiated a resolution of all outstanding issues in March, 2015, and all of the litigation was voluntarily dismissed.

Andrew Grossman isn't the typical inhabitant of the Hennepin County workhouse.

In April, the 62-year-old Twin Cities businessman was found in contempt of court for failing to pay a $10.5 million deficiency judgment to government-controlled mortgage giant Fannie Mae. The judge found Grossman "less than forthcoming" and accused him of sheltering $11 million distributed from his late father's trust in 2012.

Grossman will stay in the workhouse for six months unless he pays the debt. The two parties in the unusual case, which has stunned and mystified his longtime acquaintances, have been butting heads since Fannie Mae foreclosed on Grossman's Vintage Lakes apartment and townhouse complex in Oklahoma City in 2007.

Grossman claims that the foreclosure was illegal and fraudulent and that it involved a deliberate lowball appraisal, according to multiple documents.

An appeal to overturn the judgment has been in front of the Oklahoma Supreme Court for more than a year. But Fannie Mae has been victorious in nearly every ruling in the case.

For Grossman, investment in real estate was a sideline to his award-winning technology business, Ambient Consulting in Golden Valley. He also ran his late father Bud's car-lease empire for several years.

Grossman has taken a stridently anti-Fannie Mae stance. And in an unusual move for someone involved in legal difficulties, he has hired a widely known Twin Cities communications consultant, Jon Austin, to advise and speak for him.

"Much like the American economy, Andy Grossman was victimized in the last decade by the unscrupulous actions of Fannie Mae, which engaged in a pattern of reckless rule-breaking in order to cheat him out of his property," Austin said. "He has fought and continues to fight this injustice … because of the harm it has caused and — just as importantly — because he believes that Fannie Mae and those who enabled it must be held accountable for their actions."

Grossman can leave the workhouse during the day to run his business. But Fannie Mae's aggressive attempts to enforce the judgment have resulted in dire financial consequences for him, his lawyer wrote in a brief to the Oklahoma Supreme Court.

"He now sits on financial death row," the document said. "As a matter of public policy, Fannie Mae's record for illegal acts is formidable and has placed a plethora of individuals on financial death row."

From luxury to lowdown

Fannie Mae (the Federal National Mortgage Association) was placed into conservatorship in 2008 to stabilize its troubled financial situation because of its significant impact on the mortgage market. Many in Congress have said that the agency should be abolished, but lawmakers also face tough choices deciding how to attract enough private capital to ensure broad access to home loans.

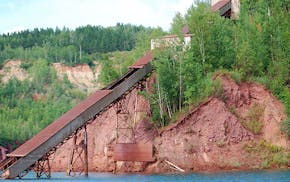

When Grossman bought Vintage Lakes, located in an Oklahoma City suburb called The Village, it was described as a luxury property. The 436-unit complex had a swimming pool and tennis courts.

A year before Fannie Mae received judgment against Grossman, The Village City Council criticized him for lack of fire protection and deterioration of the property. In 2008, The Village's city manager wrote in a newsletter that Vintage Lakes was an eyesore and the site of 30 percent of the crime in the city, but Grossman was no longer the owner at that time. The property has since been redeveloped.

Fannie Mae spokeswoman Callie Dosberg said last week that the agency tried to work with Grossman to address safety issues that followed years of neglect, but he was unwilling to make changes to make the properties livable.

But Austin said Grossman oversaw two significant rehabs of the property during his last 18 months of ownership.

"Fannie Mae continues to play 'three-card monte' with the truth, this time in an effort to obscure its misconduct from the last decade that unfairly and improperly deprived Mr. Grossman of his property," he said. "This sort of confidence game shouldn't have worked in 2007, and it isn't working in 2014."

In Grossman's Supreme Court appeal, he said appraisers purposely undervalued the property and didn't even get out of their cars to inspect it.

The property was initially set for sale in October 2007 and appraised at $9.9 million, which would have paid off Grossman's debt to Fannie Mae and earned him several million dollars. Two months later, after Fannie Mae asked for another appraisal, the property was revalued at $6 million. The property manager testified that the apartments were in the same condition during both appraisals.

Fannie Mae then bought the property for $4 million, the lowest bid allowed. Documents indicate that Fannie Mae corresponded with city officials that it wanted Grossman's property for redevelopment. In turn, that would increase the property value.

Before the sale, Grossman wanted to meet with city officials to request funding for further rehabbing Vintage Lakes, but an e-mail received by Fannie Mae officials said he had low odds of success "since hell is not freezing over." Documents also contain partial e-mails among Fannie Mae, city officials, the developer and other parties detailing how to handle actions against Grossman, including how to potentially set up the appraisal in their favor.

Grossman challenged the appraisals, foreclosure and judgment, but lost nearly every ruling. In its response to his Supreme Court appeal, Fannie Mae wrote that there was no evidence of improprieties by appraisers and that the foreclosure followed Oklahoma state law.

Money sent to Switzerland

The legal battles switched to Minnesota in 2010 when Fannie Mae moved to prevent Grossman from transferring any assets he would receive after his father died. After several appellate court challenges, Fannie Mae received a temporary injunction.

In August 2012, Grossman testified in a deposition that his father's trust distributed $11 million to him and transferred the money to a bank account in Switzerland. Several months later, he informed the court that the money had been invested and he wouldn't have access to it until 2017.

He was now in violation of Hennepin County District Judge Tom Sipkins' order to pay his $10.5 million judgment to Fannie Mae. In December, Grossman was found in contempt. The judge wrote that his move to invest the money was an attempt to shield his assets from Fannie Mae.

A contempt order in such a case is unusual, according to several legal experts.

This case was nearly settled in September 2011, after extensive meetings between Fannie Mae officials and Grossman's counsel, Austin said. Grossman agreed to pay $1 million, but the deal was vetoed by other Fannie Mae personnel, he said. Dosberg, from Fannie Mae, said Grossman was unwilling to negotiate in settlement discussions.

Friends say they are bewildered at how Grossman, a graduate of Stanford and Johns Hopkins universities, became entangled in such a long legal battle. Robert Jacobson, of New Rochelle, N.Y., said his friend is decent, trustworthy and spiritual. Grossman gives of himself, but never discusses his own problems, Jacobson said.

"We talk all the time, but he didn't share much about what was going on with Fannie Mae," Jacobson said. "There is no way he's going to give in on something he feels so strong about."

David Chanen • 612-673-4465

Marijuana's path to legality in Minnesota: A timeline

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year