The Ford Motor Co. will be receiving a Minnesota property tax refund dating back several years, after a state tax court judge reduced the appraised value of Ford's former Twin Cities Assembly Plant property in St. Paul's Highland Park.

What is not yet known is how much that will be. If the court's rulings remain unchanged, Ford may be due nearly $4 million in refunds, said Ramsey County Assessor Stephen Baker.

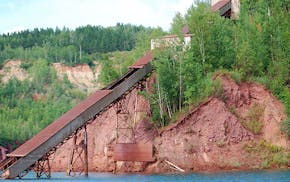

Ford was challenging the taxes it paid for 2007 through 2011, saying that the Ramsey County assessor's office had overestimated the value of the 122-acre site, which is being readied for redevelopment.

The case went to the Minnesota Tax Court for trial, and Judge Bradford Delapena last month arrived at much lower values for the site.

Delapena, chief judge of the tax court, ordered Ramsey County to recompute Ford's property taxes for the years 2007 through 2011 and pay the company refunds with interest for what it overpaid.

County officials say the property has great value as a future development site for residential and commercial use. The county's experts said the site should be valued at $35 million to $45 million.

In a 116-page opinion, however, Delapena ruled that the site's 2010 value was $21.7 million. For the other years, his decision on the site's value ranged from $33.9 million in 2006 (payable 2007) to $26.8 million in 2009.

Ford had argued in tax court that the property, a former industrial site, had no value whatsoever. In total, Ford was seeking to get back all the $10.6 million it paid for the five years in question.

County officials say Ford was arguing that since it would bear much of the cost to prepare the site for redevelopment years before seeing any income from a possible sale, it should not have to pay taxes.

Ramsey County officials had expected they would have to refund some of the money that Ford paid in the past, said attorney Marc Manderscheid, who represented the county.

He said that the original assessments were too high, especially when the economy tanked after 2006, and that later assessments didn't take into account what Ford had paid for demolition and other work to prepare the site for redevelopment.

Manderscheid said the county has filed a motion for amended findings that is scheduled to be heard in tax court Thursday. He said the county is making a couple of arguments that could change the court's judgment on the property's value by $5 million or $6 million per year.

"For most of the decision, the county is accepting of what the judge did," Manderscheid said.

Dawn Booker, an official with Ford Land based in Dearborn, Mich., which manages property owned by Ford, said the company had no comment on the decision because of continuing litigation.

The case went to trial last December. It consolidated five tax petitions filed by Ford, dating back to April 30, 2007, when the company first challenged 2007 taxes based on the valuation of the land at its Highland Park plant.

The job of the tax court was to determine the market value of the property for each of the years in question.

"This has been a very difficult case for my office," Baker said. He noted that at one point the county made a settlement offer to Ford, which the company did not respond to for three years. He said communication has been better lately with Ford, especially after the judge issued his ruling.

Still to come are four court appeals Ford has filed for the property's assessed value in the years since 2010.

"I'm hoping we can arrive at a mutual agreement," Baker said. "It's in everyone's interest to get the taxes set for this site."

James Walsh • 651-925-5041

Video goes viral of man enduring 'shocking' chain whipping on downtown St. Paul street

Report: Former Minneapolis police oversight director disparaged women, threatened staff

Minnesota sales, clean-ups and other events to celebrate Earth Day and Arbor Day

Marijuana's path to legality in Minnesota: A timeline