Lindsey Rafnson has been busy.

Since buying her Eagan town house in June, she has banished the brightly painted walls in favor of more neutral tones, replaced dated brassy light fixtures and removed the old carpet and the coating of cat hair that had covered it.

By the time the holidays rolled around, she was ready to show off her first house.

"I had friends over and had a dinner party," Rafnson, 26, said. "It was super fun."

She bought the three-bedroom, three-bath town house with the help of $6,000 in down payment assistance from the Dakota County Community Development Agency's First-Time Homebuyer Program.

There are a variety of home buyer assistance programs across the metro area that target specific neighborhoods or foreclosed properties. But outside of Minneapolis and St. Paul, Dakota County CDA is the only agency that offers a widely available program for first-time buyers.

The program, which has been around since the mid-1980s, offers up to $10,000 in down payment assistance and low-interest, fixed-rate loans to people who qualify and decide to buy within the county.

While it's not as high profile as the $8,000 federal tax credit for first-time home buyers that expired last year, the CDA's First-Time Homebuyer Program has helped more than 5,500 people over the years. In 2010, 205 buyers took advantage of its offerings.

"Once the [federal] credit went away in April, the first-time home buyers went, 'I guess there's no more for me,'" said Sally Settle, a loan officer with PHH Home Loans. She said she tells all her clients about the Dakota County program. "This is available for all Dakota County homes, if you meet the income limits."

For example, a two-person household could qualify for down payment assistance if their combined income is $84,000 or less and the house they are buying does not cost more than $276,683.

The amount of down payment assistance varies by income and comes in the form of a no-interest loan, which does not have to be paid back until the homeowner sells or refinances.

Mark Ulfers, executive director of the CDA, said the county lobbied for bonding authority to launch the program in the 1980s, partly because it was a way to help young families put down roots in the area.

"There's a lot of expectation around suburban communities doing their share for affordable housing," Ulfers said. "Having the money for closing costs and the down payment is the single biggest barrier we've seen for folks."

It's also a way to educate potential home buyers about the complicated process and help them make smart choices, he said.

All participants attend classes to learn about budgeting, credit scores, mortgages and the real estate process. The ceiling on eligible purchases also prevents people from buying more house than they can afford.

In the continuing foreclosure crisis, "how many people did that?" Ulfers said.

Dakota County saw 1,787 foreclosures in 2009, after a record high of 2,063 in 2008. Unfortunately, Ulfers said, the total for 2010 will likely approach that of 2008.

For Cindy Foster, who bought an Apple Valley town house last year, the home ownership classes were as useful as the down payment assistance.

"It just makes it really easy to understand and less scary," she said. "It takes you from the first step to the last step."

She focused her home search on Dakota County when she learned about the program, and ultimately ended up buying a two-bedroom, 1 1/2-bathroom town house for $110,000. Her monthly mortgage payment is less than her rent was before.

Without the program, Foster said, "I couldn't have bought my house. I'd still be renting and saving for the down payment."

Katie Humphrey • 952-882-9056

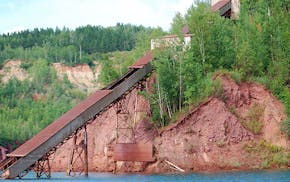

Minnesota to close state park on Iron Range, turn it back into a mine

Marijuana's path to legality in Minnesota: A timeline

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year