Macy's is in talks with a potential developer for its downtown Minneapolis property but has not yet committed to whether it will shutter its store.

The Cincinnati-based retailer, under pressure from activist investors amid a tough environment for department stores, is looking to either sell or generate more value from its real estate holdings across the United States.

The Star Tribune reported in October that Macy's was looking to shed the downtown property and was considering closing or downsizing the store. Since then, City Center Realty Partners (CCRP) has risen to the top of a list of interested buyers, according to people briefed on the situation. A Macy's representative and CCRP arranged two meetings with city officials in October to discuss the options. But city officials said they did not receive a definitive answer on whether the store would close.

"We have not heard that officially," said David Frank, director of economic development. "I think it's well known that the building is too big for the current use, so we're very interested in what happens to the store and to the building."

He said the city has had some contact with Macy's and has been told the company is still working on a plan for the site.

Known best locally as the longtime flagship of the Dayton's Department Store chain, the building at 700 Nicollet Mall was the ultimate retail destination in Minnesota for decades. The property is huge, with nearly 1 million square feet or about two-thirds the space of the 57-story IDS Center, Minnesota's tallest office building.

Possible outcomes include selling the building and leasing back space, selling the building and pulling out the retail operation or closing the store without a buyer in place.

But the company has been open about the challenges of continuing to do business on the site.

"Macy's has told us that the retail environment in that particular store is extremely challenging, and it's no secret that across the country they're looking to divest themselves of real estate, and this is one of the stores they're looking at," said City Council President Barb Johnson.

Macy's has divided all of its properties into three camps.

First, the company announced in August plans to close 100 of its stores nationally. Second, Macy's announced last month it hired Brookfield Asset Management to explore redevelopment options on another 50 stores.

The third group consists only of Macy's downtown flagship properties, such as New York, Chicago and Minneapolis, which have the most uncertain future. The company is taking a more-tailored approach to each of these downtown properties, which could have varying fates depending on local factors.

Three weeks ago, Macy's announced a deal for one of its flagship properties at Union Square in San Francisco. The company is selling the Men's store building for $250 million and will incorporate the Men's store into the main Macy's store at Union Square, essentially downsizing its retail presence.

But the company also announced last month the outright sale and closure of its property in downtown Portland, Ore., which is not considered a "flagship" property but is similar to Minneapolis in that it is located in an old building in the center of the city.

Johnson was in one of the Minneapolis meetings with the retailer. While Macy's expressed serious concern over the viability of the store, Johnson said, the company has not acknowledged a formal decision or outlined a future timeline.

Macy's said it has nothing to announce, and Mayor Betsy Hodges declined to comment on the matter when asked Friday morning in a corridor of City Hall.

The downtown Minneapolis Macy's has been the source of speculation — and real estate dealings — for several years. Last year, Macy's was negotiating the sale of the downtown Minneapolis building to Trammell Crow Co. and Sterling Bay Co., but that joint-venture deal fell through, said sources with direct knowledge of the discussion.

CCRP is a San Francisco-based firm that specializes in redeveloping urban properties and has an office in Minneapolis. The company has been involved in several other high-profile redevelopments including the TractorWorks building, which was sold for nearly $55 million in 2014 to an entity related to Goldman Sachs.

Staff writer Eric Roper contributed to this report. Kristen Leigh Painter • 612-673-4767

Marijuana's path to legality in Minnesota: A timeline

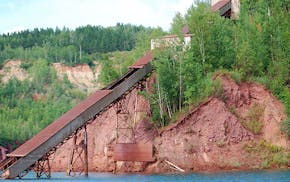

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year