Jurors have convicted a former Bayport real estate developer and business owner of tax evasion and fraud following a six-day trial in U.S. District Court in Minneapolis.

Bartolomea J. Montanari, 57, who now lives in Knoxville, Tenn., was indicted in May on one count of evading taxes, one count of mail fraud and one count of wire fraud. He was found guilty on all counts.

U.S. District Judge Ann D. Montgomery will sentence Montanari after a presentence investigation. A sentencing date has yet to be set.

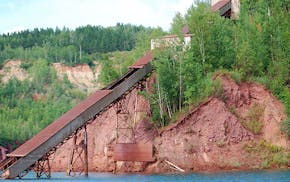

Montanari was accused of evading payment from 2009 to 2012 of employment and excise taxes owed by him and three businesses he controlled: St. Croix Development, Emlyn Coal Processing and Montie's Resources.

One of the ways he avoided paying taxes and penalties for late payments, the charges say, was by transferring more than $1.1 million into a bank account in the name of Bella Luca Properties LLC, a shell company with no legitimate business purpose but used by Montanari to pay personal expenses. Montanari evaded payment of more than $700,000 in taxes and penalties to the federal government.

In December 2009, when the IRS attempted to collect taxes and penalties, Montanari filed a fraudulent financial statement making numerous misrepresentations to the IRS to avoid paying the taxes he owed, the charges add. For example, he did not disclose several personal vehicles that he owned and denied the existence of the Bella Luca bank account, which he was using to receive monthly compensation of $50,000 from two of his companies. Montanari also lied about living in Bayport, when he had already moved into a $1.4 million house he was buying in Knoxville.

In addition, as part of a fraud scheme, the charges say he lied about the sale price of a bulldozer that he needed to purchase for one of his companies. Montanari submitted a doctored invoice to the dozer financing company, which issued a check for $100,000 more than the true purchase price. Montanari kept the extra $100,000 and used it as a down payment for the house in Tennessee.

Jim Anderson • 651-925-5039

Video goes viral of man enduring 'shocking' chain whipping on downtown St. Paul street

Report: Former Minneapolis police oversight director disparaged women, threatened staff

Minnesota sales, clean-ups and other events to celebrate Earth Day and Arbor Day

Marijuana's path to legality in Minnesota: A timeline