CHARLES PETERSON, JUNIOR

Major: Sociology, African-American studies

Peterson didn't think he'd be able to take classes at the University of Minnesota this semester. He depends on loans, and this semester he wasn't offered enough to cover costs.

"I pay, out of pocket, about $3,000 a semester," he said. "It's a lot easier coming up with it for fall semester, because you have the summer. Spring's always down to the wire."

So Peterson filled out the paperwork for a leave of absence, found a job in Madison, Wis., where his family lives and moved into an apartment with his brother. On the first day of class, he got a call from his father. He had worked out a payment plan with the U's financial aid office. "To wake up that morning and hear I was going back to school was good news."

Now, Peterson is working 25 to 30 hours a week as a security officer for the U, saving up for his remaining semesters. He hopes to attend graduate school for social work -- despite the additional loans. He believes it's a good investment.

ANDY POST, JUNIOR

Major: Marketing

"The public doesn't fully understand the value the U offers the state of Minnesota, because we probably aren't communicating it well to them," Post said. "They don't see leading global research. They don't see outstanding business school. The people on the street see new stadiums. They [stadiums] add value -- they're not worthless -- but the university needs to announce that connection more.

"If I was the governor and I had to cut health and human services or ... a new stadium ... that's an easy choice."

"I think the university has made an effort to cut the fat," said Post, who will graduate with up to $25,000 in student loan debt.

ANDY GUAN, FRESHMAN

Major: Biomedical engineering (planned)

Guan was drawn to the U because of research opportunities with top-ranked professors, and he is undeterred by the specter of tuition increases.

But the Fridley resident is feeling pinched by the economic slump. His parents own and operate Hong Kong Kitchen, a restaurant in Fridley, and contribute about $8,000 per semester to his education. They're finding it increasingly difficult to pitch in, so Guan and his brother, a U junior who doesn't get parental aid, are cutting back on expenses, including movies, eating out and new clothes. He plans to look for work so his parents can stop contributing to his education, and he can graduate without student loan debt, if possible.

"I'm a little worried," Guan said of his financial situation. "Loans are always kind of scary."

RACHEL HUSEBY, FRESHMAN

Major: Considering biology

U freshman Rachel Huseby of Moorhead expects to graduate with about $20,000 in student loan debt. She said that she's solely responsible for funding her education and that every extra dollar the U asks of her hurts.

She started the school year with $4,000 in scholarships, and a work study job at a university dining hall. But she eventually quit work when it interfered with her academics.

"Cost was a huge factor," she said of selecting a college. "Everything, even an extra $500, it's like, 'Where am I going to get that?' They say education is the greatest asset to society. They should make it more attainable."

CHAO XIONG, JENNA ROSS

Marijuana's path to legality in Minnesota: A timeline

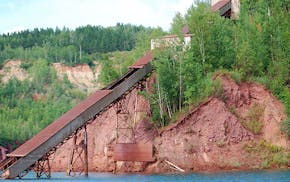

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year