They're called online penny auctions, but too many of them have ended up costing the bidders serious dollars, with nothing to show for it. The Better Business Bureau is warning consumers to do their homework before trying to win penny auctions.

The popular auctions work like this: Bidders pay money up front for the right to bid, pennies at a time, for products such as iPods, cameras, video game consoles and computers. The item is yours if you're the last bidder when the time runs out for the auction, even if it costs a tiny fraction of its retail price.

But some of the auctions are rigged, the BBB warns. Even if you don't win, you have to pay for the bids you placed. Those pennies add up.

"The BBB has received hundreds of complaints from consumers about penny auctions so far this year and we're encouraging online bargain hunters to do their research," said Dana Badgerow, president and CEO of the BBB of Minnesota and North Dakota. Look up the auction on www.bbb.org, or call the BBB at 1-800-646-6222.

America's worst credit card? Ron from Anoka County got a credit card offer in the mail the other day, the first since he came out of personal bankruptcy. Credit limit for the First Premier Bank MasterCard: $700. Annual fee: $175. Interest rate: 24.9 percent.

Ron called the terms "disgusting" and said he would never apply. The November issue of Consumer Reports calls it "America's worst credit card" and notes that three years ago, the Sioux Falls, S.D., bank signed a $4.6 million settlement with New York over allegations of the card's "deceptive marketing practices."

A call to First Premier Bank was not returned last week. On its home page, the bank entices credit card applicants with the phrase, "Less than perfect credit?"

Fraudsters in Ferraris The government loves it when the targets of fraud investigations buy mansions and drive around in Porsches and a Ferrari. Earlier this month, the Federal Trade Commission shut down a Beverly Hills, Calif., company that it says swindled 20,000 people nationwide with phony claims that it could reduce their taxes.

It cost as much as $25,000 up front to get the services of American Tax Relief, but the husband-and-wife owners, Alexander Seung Hahn and Joo Hyun Park, were the ones who lined their pockets by selling an "essentially useless service," in the words of one FTC official. A Chicago judge issued a restraining order against the company and a receiver was appointed to manage it, the Los Angeles Times reported.

COMPILED BY WHISTLEBLOWER TEAM

Marijuana's path to legality in Minnesota: A timeline

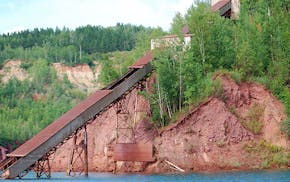

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year