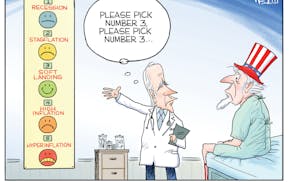

Opening up a hospital bill and staring at an unexpectedly large sum listed as "Patient's Responsibility" is an experience too many Minnesotans, even those with robust health insurance, can relate to. Side effects triggered are also unforgettable: high blood pressure, anxiety and feeling like you've taken a punch to the gut.

The phenomenon occurs often enough here and elsewhere that it has its own name — "surprise medical bills." Because of the nation's fragmented health insurance system, the patchwork of regulations governing it and the Byzantine billing process, patients who thought they were covered can be saddled with thousands of dollars of out-of-pocket expenses. One common scenario is when an out-of-network specialist provides care at a hospital within the patient's insurance network, resulting in higher fees and cost-sharing for the insurance policyholder.

Fortunately, political leaders not only are taking note of growing consumer anger but are beginning to act on it. Last week, a bipartisan group of U.S. senators led by Bill Cassidy, R-La., and Michael Bennet, D-Colo., released draft legislation to rein in surprise medical bills. The bill's formal introduction isn't expected until January, but its public debut is welcome and will put a timely spotlight on the problem's prevalence.

Good journalism merits credit for putting this on the political radar. Cassidy's announcement cites a Texas man stuck with a $109,000 heart-attack bill whose plight was featured in a Kaiser Health News and National Public Radio collaborative.

Drew Calver, a 44-year-old teacher from Austin, Texas, had insurance through his employer. But he went to the closest hospital for care after collapsing on his bedroom floor. The facility was not in his insurer's network. When his insurer and the hospital squabbled over a reasonable price for his care, a bill was sent to Calver for the difference.

That practice is known as "balance billing.'' Minnesota and a handful of other states have some state-level protections to clamp down on this and other practices leading to surprise medical bills. But federal protections like those in the Cassidy draft bill are still an "important advance," according to the Minnesota Department of Commerce. A key reason: Employer-provided health plans are often federally regulated, so state-level protections may not apply.

In addition, most other states do not have comprehensive consumer protections in place. Federal safeguards would eliminate the regulatory patchwork that leaves patients at financial risk.

With all of that said, the Cassidy bill would not be a panacea even if it passes, according to Jon Hess, the CEO of Athos Health in St. Paul. The firm reviews medical bills to prevent employers and consumers from overpaying.

Hess said the legislation is a good start but doesn't appear to address several common triggers of unexpected bills. One is when consumers have to meet a higher deductible amount for out-of-network care. Another is when miscommunication occurs between the insurer and provider during "pre-authorization" for procedures.

Yet another is when a preventive service, which may be covered at little or no cost, encompasses additional medical care. An example: Polyps found during a colonoscopy are often removed during this procedure. But the removal may not covered as a preventive service, leading to a higher-than-expected bill.

Still, Hess said, the Cassidy bill is a step forward for patients and their families. "Consumers need a voice. They need protection. This seems to be a very simple thing to do to get behind to help these people.''