UnitedHealth Group Inc. said Wednesday that it is sharply raising its dividend and will make payouts more frequently, heeding longtime entreaties from investors.

The Minnetonka-based insurer raised its annual dividend to 50 cents per share, to be paid quarterly. The first payout of 12.5 cents per share will be made June 21 to all shareholders who've held the stock for at least two weeks.

The most recent annual dividend was 3 cents per share, paid last month.

Coming in the midst of a historic restructuring of the health care system, the move should pacify jittery shareholders wondering if the company will see profits squeezed by new regulations.

"I'd call it reassurance," said David Heupel, a portfolio manager with Thrivent Asset Management in Minneapolis. "The idea of these guys being able to pay out this amount of cash year in, year out gives a fair amount of comfort to investors."

Heupel said the move is likely to spur new interest from investors who require a reasonable yield before they will look at a stock.

A full year of dividends would make up 12 to 13 percent of UnitedHealth's 2010 projected cash flows from operations, the company said.

UnitedHealth, which is America's biggest health insurer by revenue, already has a sizable cash cushion. At the end of the quarter ended March 31, it reported it had $11.1 billion in cash and other short-term investments.

The company spent $626 million buying back its shares from the market in the first quarter. In the past, some investors have criticized UnitedHealth's habit of buying back shares to prop up its share price and boost earnings per share, saying the money should go back to shareholders in the form of higher dividends.

The company had resisted -- until now. The company said UnitedHealth's board approved the higher dividend at its regular meeting on Tuesday "after reviewing the company's business outlook and future capital requirments."

Said Heupel: "This is a signal that they are not a high-growth business but a more mature company than they used to be."

The company said it is not letting up on share repurchases or acquisitions of complementary businesses.

"Our disciplined capital stewardship enables us to continue to return capital to our shareholders," Chief Executive Stephen Hemsley said. "We are increasing the size and frequency of our dividends, while continuing an effective share repurchase program, making sound investments in growth and maintaining a strong balance sheet and financial flexibility."

UnitedHealth stock rose on the news Wednesday but later fell; it closed at $28.79, down 8 cents.

Chen May Yee • 612-673-7434

Biden visits his Pennsylvania hometown to call for more taxes on the rich and cast Trump as elitist

Business boom: Record numbers of people are starting up new small businesses

Participant, studio behind 'Spotlight,' 'An Inconvenient Truth,' shutters after 20 years

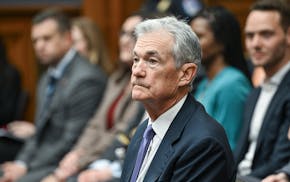

Fed's Powell: Elevated inflation will likely delay rate cuts this year