The rise of e-commerce is having profound effects on demand for industrial warehouses. Suddenly, inner-city buildings once rejected as too small or too old are in demand.

Benefiting the most from this turnaround are close-in urban locales such as Minneapolis' Mid-City Industrial submarket, which had been perceived as declining. For years, the most active warehouse development has been in far-flung exurbs, such as Rogers and Shakopee, where users could construct new buildings with ceilings as high as 32 feet to stack huge amounts of inventory at a single location.

However, the rise of e-commerce is scrambling that. Consumer demands have shifted to same-day or next-day delivery, and since many consumers live and work close to the city center, more companies are realizing it may not be such a good strategy to have everything they have stored far from the urban core.

As a result, the Mid-City area — generally south of Interstate 35W and west of Hwy. 280 in northeast Minneapolis — is getting significantly more attention from prospective tenants, according to local industrial real estate professionals. Despite the low ceilings, age and lack of amenities that once made them so undesirable, Mid-City warehouses have one key asset: They are within striking distance of the cores of both Minneapolis and St. Paul.

"It feels to me that Mid-City is becoming more in demand, that there's more and more clients who want to be around there," said Chris Garcia, a principal with St. Louis Park-based Lee and Associates, a commercial brokerage. "You can see why. It's pretty much exactly in the center of the Twin Cities, and so as time goes by, that space is becoming more valuable to e-commerce users.

"These companies are trying to establish two- or three-hour delivery operations, and you really can't get any more centralized than that."

Garcia said he's close to completing a significant lease deal for a property within the Mid-City area, which is dominated by 1970s-era, single-story warehouses with clear ceiling heights of only 18 or 22 feet. If those same buildings were elsewhere, they would likely be languishing with high vacancies. Such buildings in suburban areas remain a hard sell, especially for users who are not as dependent on e-commerce.

Mid-City has seen some major changes recently. For instance, appliance dealer Warners' Stellian in March purchased an underutilized, 44,000-square-foot building at 2601 Broadway Av. NE. from Boyer Ford Trucks for conversion into a warehouse; that same month, national retailer Costco unveiled plans to convert a renovated, 175,000-square-foot former circuit-board manufacturing plant at 3311 Broadway Av. NE. into a Costco Business Center outlet.

But perhaps the best illustration from the area's rising industrial real estate value was the recent purchase of the 1301 Industrial Blvd. building.

The sprawling 350,000-square-foot building was built in 1970 as a U.S. Postal Service distribution facility and in recent years was converted into a distribution center focused on time-sensitive deliveries by St. Paul-based Superior 3rd Party Logistics.

That company in October sold the building to SR Realty Trust — a REIT controlled by Minneapolis-based developer Schafer Richardson, for $14.7 million, according to a certificate of real value — then leased it back.

"There were a number of attributes that initially attracted us to the 1301 Industrial property," said Evan Richardson, a vice president with Schafer Richardson. "First and foremost was the property's location on I-35W within the Mid-City Industrial submarket. Mid-City benefits from proximity to downtown Minneapolis and the rapidly expanding urban population, good access to the freeway system, and options for rail service.

"These factors," he added, "make [Mid-City] an ideal location for local distributors, logistics, and retail companies, especially those focused on reducing the cost of their 'last mile.' "

Don Jacobson is a freelance writer based in St. Paul. He is the former editor of the Minneapolis-St. Paul Real Estate Journal.

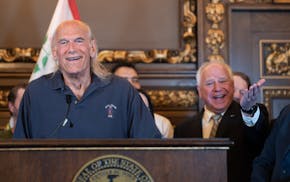

Former Gov. Jesse Ventura boasts he could beat unpopular Trump or Biden if he ran for president

Dave Kleis says he won't run for sixth term as St. Cloud mayor

Newspaper boxes repurposed as 'Save a Life' naloxone dispensaries

St. Cloud house vies for Ugliest House in America