Fraud charges swirling around Twin Cities businessman Tom Petters have spawned two more bankruptcies, including a Chapter 11 filing for Petters Company Inc., the financing arm that allegedly was used to deceive investors.

Minnetonka-based Petters Co. listed liabilities of between $500 million and $1 billion in its petition filed Saturday night in U.S. Bankruptcy Court in Minnesota. U.S. Bankruptcy Judge Gregory Kishel will preside over that case.

In a related bankruptcy filed by Petters Group Worldwide, the parent company listed liabilities of $50,000 or less.

"This action was taken as a protective measure," Andrea Miller, a Petters spokeswoman, said Monday. "It provides the court-appointed receiver, Doug Kelley, time to assess the businesses and develop plans for them that best serve the interests of their creditors, employees, suppliers and customers."

Kelley said Thursday he's evaluating which Petters' companies can be saved and which businesses should be sold or closed.

Polaroid, based in Massachusetts, remains an ongoing business. Meanwhile, Great Water Media, which published magazines in the Twin Cities, is up for sale, Miller said Monday. Magazine staff were among Petters employees laid off from their jobs on Friday.

The 20 largest unsecured creditors in the Petters Co. bankruptcy include large investment funds, a nonprofit organization and individuals.

Ritchie Special Credit Investments, based in Illinois, is listed with a claim of $111.8 million. Minneapolis-based Interlachen Harriet Investments is on the claim list for $69 million, and the Dorsey & Whitney law firm, Minneapolis, has sued Petters in an attempt to recover the Interlachen investment.

Michelle Vlahos of Wayzata has the largest individual claim at $18.8 million. Her husband, restaurateur and businessman Dean Vlahos, is a longtime friend of Tom Petters.

"I'm one of the biggest victims you've got," Dean Vlahos, owner of Redstone American Grill restaurants, said in a Monday interview.

Michelle Vlahos filed for a divorce this summer, but Dean Vlahos said he and his wife are both creditors in the Petters case. "We lost it together," he said. Michelle Vlahos could not be reached Monday for comment.

Dean Vlahos said he has been investing with Petters for at least 10 years.

"I never had any issues whatsoever with the investments we had" with Petters, he said. "It was always what it said it was going to be."

Vlahos said that he believes the money owed to him and his wife is less than the $18.8 million reflected in the bankruptcy case filing, but he did not release a precise figure.

"The money, I can make again," Vlahos said. However, he added, "I am shocked just like anyone else who is in his inner circle" about the Petters fraud charges.

Petters also is a significant investor in the Redstone company, Vlahos said.

Ted Deikel, who previously bought Fingerhut with Petters, also appears on the creditors list. His claim is $10 million.

"I most likely will lose a large sum of money," Deikel said Monday night. But he added that he's still totally perplexed by the alleged fraudulent behavior of Petters. "I can't reconcile it in my mind," Deikel said. "It's just unbelievable. This is a person everybody has looked at as successful, charitable, helpful and supportive."

While he said that Petters must still have his day in court, if the charges are true that it would be "an awful breach of trust."

The largest creditor is Metro Gem Inc., based in Nevada and operated by Frank Vennes Jr.

The Shorewood home of Vennes was raided Sept. 24 when federal agents fanned out across the Twin Cities to seize evidence in an alleged Ponzi scheme. Three of Petters associates have entered guilty pleas in the fraud scheme. Vennes has not been charged.

In a federal search warrant, Vennes is characterized as a facilitator who enticed major investors to transfer $1.2 billion to companies controlled by Tom Petters.

Sun Country Airlines, where Petters owns the voting stock, filed for bankruptcy protection a week ago. The Mendota Heights-based carrier has the ability to restructure on its own in Chapter 11 and is not under the auspices of Kelley, the court-appointed receiver.

Petters remains jailed on fraud charges after being denied bail.

Staff writer Jon Tevlin contributed to this report.

Liz Fedor • 612-673-7709

Biden visits his Pennsylvania hometown to call for more taxes on the rich and cast Trump as elitist

Business boom: Record numbers of people are starting up new small businesses

Participant, studio behind 'Spotlight,' 'An Inconvenient Truth,' shutters after 20 years

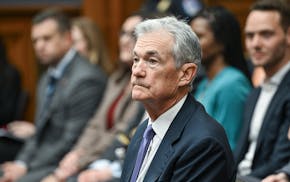

Fed's Powell: Elevated inflation will likely delay rate cuts this year